COVID-19: Those least equipped to endure economic downturn bearing the brunt of layoffs

One-third worry their household will be late on a mortgage or rent payment as outbreak roils economy

March 25, 2020 – As the COVID-19 outbreak continues its vise-grip on the health, day to day lives, and economic fortunes of Canadians, the latest public opinion survey from the non-profit Angus Reid Institute finds those hardest hit by recent layoffs and mass shutdowns are also those least likely to be able to absorb the financial losses their new circumstances may bring.

Already, 44 per cent of Canadians say that they or someone in their household has lost hours due to the economic downturn. Among this group, the majority say their employers are not covering any of their now disappeared wages.

Another example of just how precarious the situation is becoming, as Canadians look for financial support: one-in-three across the country (34%) say they worry their household may miss a rent or mortgage payment this month or have to start borrowing money (32%) or have already done those things.

Further, two-in-five (37%) of those who have experienced job loss in their household say they’re not equipped to handle even an extra $100 expense in the next 30 days.

More Key Findings:

- Among those who are currently working, almost half say it is just a matter of time before their hours are cut as well

- Half of those who have applied for employment insurance (51%) say it has been a difficult process and they have yet to be paid

- Six-in-ten (61%) Canadian households now say the value of their investments have been reduced. But the majority of investors (76%) are so far optimistic about the prospects of this value bouncing back

About ARI

The Angus Reid Institute (ARI) was founded in October 2014 by pollster and sociologist, Dr. Angus Reid. ARI is a national, not-for-profit, non-partisan public opinion research foundation established to advance education by commissioning, conducting and disseminating to the public accessible and impartial statistical data, research and policy analysis on economics, political science, philanthropy, public administration, domestic and international affairs and other socio-economic issues of importance to Canada and its world.

METHODOLOGY:

The Angus Reid Institute conducted an online survey from March 20 – 23, 2020 among a representative randomized sample of 1,664 Canadian adults who are members of Angus Reid Forum. For comparison purposes only, a probability sample of this size would carry a margin of error of +/- 2.5 percentage points, 19 times out of 20. Discrepancies in or between totals are due to rounding. The survey was self-commissioned and paid for by ARI. Detailed tables are found at the end of this release.

INDEX:

Part One: COVID-19’s Immediate Economic Damage

-

Lost hours and anticipated layoffs

-

Most who have lost hours are not being bridged by employers

Part Two: Canadians on the Edge

-

One-quarter cannot handle an additional expense this month

-

Tough decisions anticipated as bills come due

-

Most trying to access EI report difficulties

-

Will their jobs ever return?

Part 3: Investors put their faith in a recovery

Part One: COVID-19’s Immediate Economic Damage

Lost hours and anticipated layoffs

As the COVID-19 pandemic deepens, self-isolation and the need for physical distancing has first caused Canada’s economic engine to gear down and threatens to take it to a dead-stop. Canadians themselves are reeling from the immediate effects. Two-in-five Canadian households report having experienced work loss since the outbreak began, while another one-in-five anticipate loss:

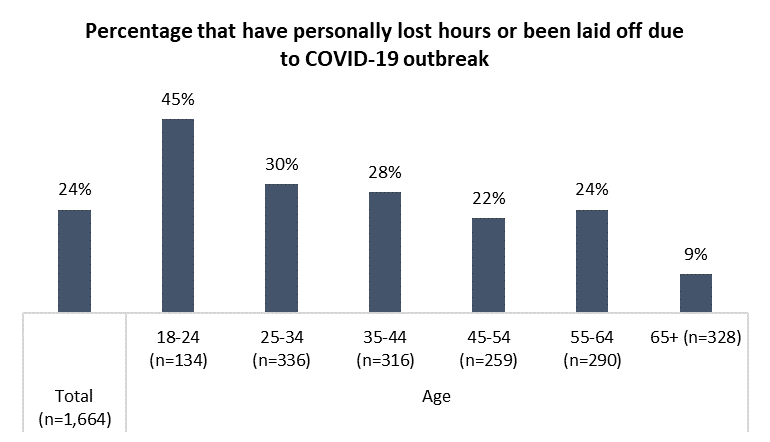

Those who are younger are far more at risk. Among 18-to 24-year-olds, nearly half report losing work. This drops with age, but remains above one-in-five for all of those under 65:

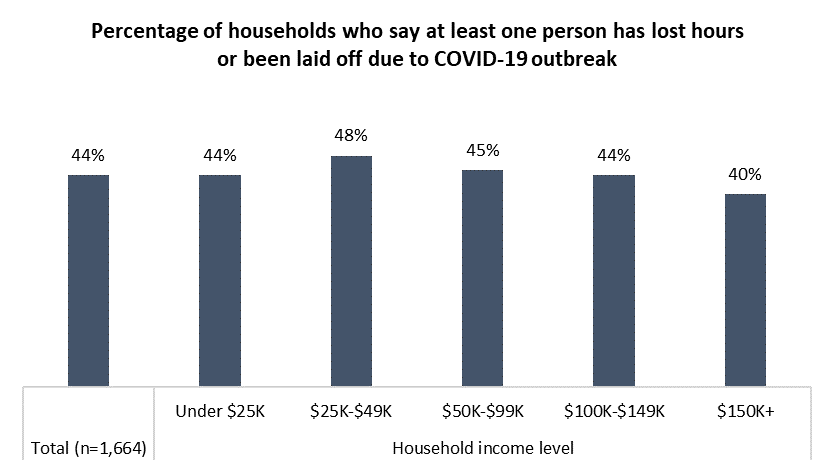

It is worth noting that this crisis does not discriminate by earnings. At the household level, two-in-five across all income levels report losing hours because of the outbreak and ensuing economic crisis:

Regionally, no portion of the country is unscathed. At least one-third of households in every region have had someone lose work already:

Most who have lost hours are not being bridged by employers

As businesses – especially small ones – shut their doors or significantly curtail activity, the impacts on their employees have been devastating. And while some business owners are continuing to pay their staff, most are not:

Part Two: Canadians on the Edge

One-quarter cannot handle an additional expense this month

Asked just how much of a one-time expense they could absorb in the over the next month, more than one-in-five Canadians say that they are already at their limit. That number has increased over the last two years. When Canadians were asked the same question in a wide-ranging study of economic issues in the summer of 2018, 14 per cent said they had no financial wiggle room at all:

Troublingly, those who are least able to handle any extra expenses are more likely to have lost hours already. Nearly three-in-ten in this cohort say so:

Tough decisions anticipated as bills come due

For millions, the economic effects of the coronavirus panic will mean difficult trade-offs. Buy groceries or pay the heating bill? Borrow to pay the rent on time, miss a payment? For many Canadian households, these experiences already represent a recent problem. For even more, it’s a problem they see looming.

When these realities – or expected ones are compared across varying work circumstances, it becomes clear that the situation for those who have already lost work – or anticipate losing work in the future – is stark:

*responses above 40% highlighted

Most trying to access EI report difficulties

The federal government reported more than 500,000 applications for employment insurance this past week. And while an $82 billion bailout package that includes extending eligibility for EI and benefits to help businesses and individuals that may not have previously been able to access them is in the works, it isn’t yet online. Nine-in-ten Canadians say they are aware of this aid package (see detailed tables).

Three-in-ten Canadians (31%) who say that they have lost hours report applying for EI already:

As for the process of applying for EI itself, half who have tried it already tell the Angus Reid Institute the course of action was “difficult”, and they haven’t yet been able to access benefits:

Will their jobs ever return?

Do Canadians whose jobs have been lost or curtailed by the COVID-19 outbreak see the situation as permanent or something to ride out? For half (48%), the prospect of their hours being fully restored once the worst is over is a certainty. For the rest, however, the mood is grimmer:

Part 3: Investors put their faith in a recovery

COVID-19-driven volatility and panic in the financial markets have been wreaking havoc on the investments and pension plans of millions in this country. The Dow Jones had its worst week since the 2008 financial crisis and the Toronto Stock Exchange has also dropped precipitously. As a result, 51 per cent of Canadians, and 61 per cent of Canadian households report taking losses:

These losses are concentrated among higher-income households, but significant numbers across all income levels have been hurt (see detailed tables). While three-quarters (76%) of those who have seen their investment value decrease are confident that it will eventually return, one-quarter (24%) are not so optimistic:

For detailed results by age, gender, region, education, and other demographics, click here.

For detailed results by household layoffs, click here.

To read the full report, including detailed tables and methodology, click here.

Click here to read the full questionnaire used in this report.

MEDIA CONTACTS:

Shachi Kurl, Executive Director: 604.908.1693 shachi.kurl@angusreid.org @shachikurl

Dave Korzinski, Research Director: 250.899.0821 dave.korzinski@angusreid.org

Image Credit – Photo 150744585 © Kawee Srital On | Dreamstime.com