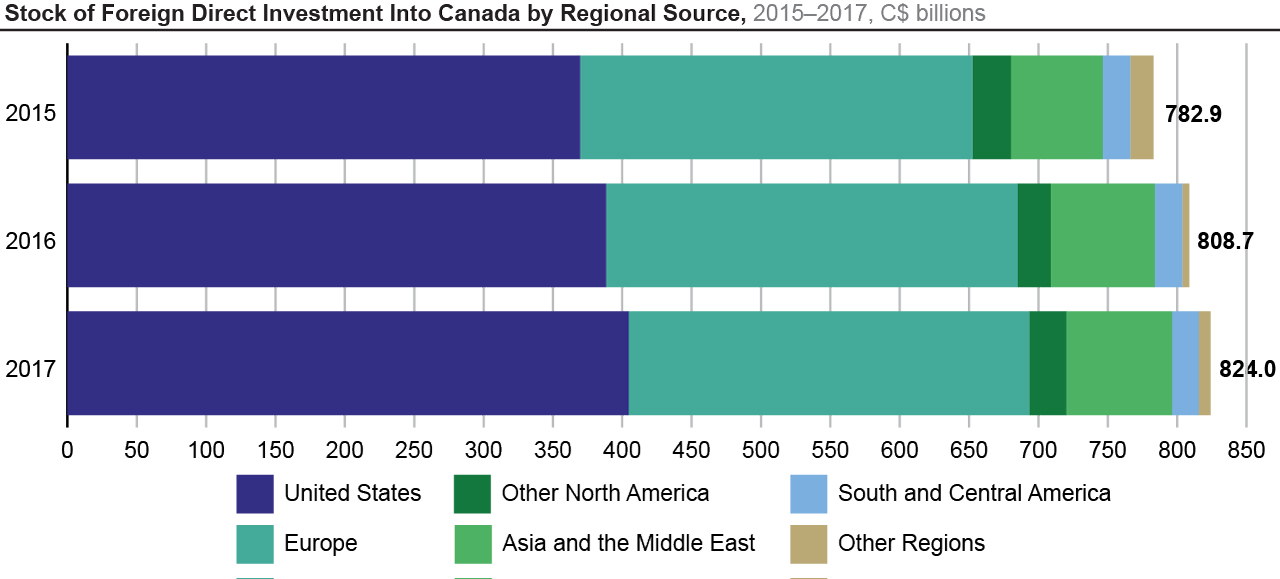

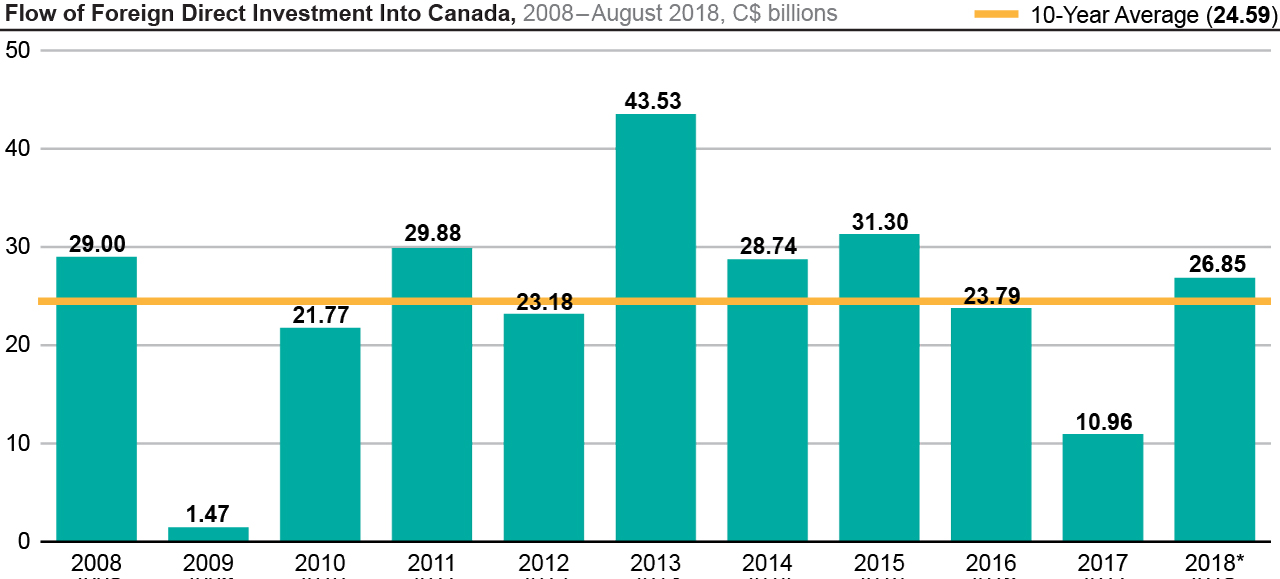

Two-way US-Canada foreign direct investment (FDI) is roughly balanced; the US accounted for more than half of the stock of FDI into Canada, while Canada was the second largest source of the stock of FDI into the US in 2017. The flow of FDI into Canada saw a net decline in 2017, in part due to a slump in the energy sector, but rebounded in 2018 with new manufacturing, tech, logistics and financial services investment. Southern California’s large population and manufacturing base have attracted a larger share of Canadian manufacturing, aerospace, and retail investment; the Bay Area has drawn more technology, biotech, renewable energy and finance investment.

With the loss in the 2000s of technology industry leaders, such as RIM (Blackberry) and Nortel Networks, and an overreliance on natural resources, Canada today is increasingly driving toward an economy that is innovation led. Its efforts to diversify, attract global talent, and move up the skills and employment value chain are yielding impressive results in secondary and post-secondary education, research, and technology fields such as AI.

Under a consolidated Ministry of Innovation, Science and Economic Development, Ottawa has established regional innovation “superclusters” across Canada to attract public and private investment in education, basic research, and entrepreneurship. The Toronto, Montreal, Quebec City, and Vancouver metro areas have developed dynamic university, incubator/accelerator, and VC funding networks; in rural and maritime provinces, entrepreneurs are developing digital and AI solutions in mining, agriculture, forestry, fisheries, and renewable energy. Toronto, Vancouver, and Montreal are growing tech hubs.