The Toll of Inflation: Soaring prices has four-in-five Canadians pinching pennies

Most believe grocery stores are taking advantage of inflation to boost profits

August 22, 2022 – Statistics Canada may have reported cooling inflation rates in recent days, but the summer of price increases continues to simmer.

The level of month-to-month price increases was the lowest so far this year. However, prices have risen by 7.6 per cent since July 2021, meaning there is much work for the Bank of Canada left to do to return the country to its target rate of two per cent.

Through it all, many Canadians are responding to price increases with spending decreases, according to new data from the non-profit Angus Reid Institute

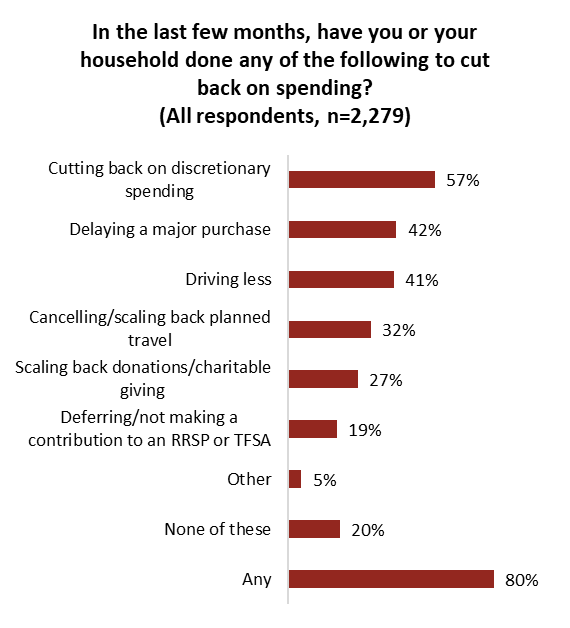

Fully four-in-five say they have cut spending in recent months by either trimming their discretionary budget, delaying a major purchase, driving less, scaling back travel and charitable donations, or deferring saving for the future. This represents an increase from the three-quarters (74%) who said so in February.

A financial temperature check of Canadians finds many sweltering in the heat of inflation. Half (52%) say they couldn’t manage a sudden expense of more than $1,000. For two-in-five (38%), a surprise bonus of $5,000 would be used to alleviate the pressure of debt. For one-in-ten, it would immediately be put towards daily expenses.

Regionally, some parts of the country seem to be feeling more financial pain than others. Those in Saskatchewan (58%) and Atlantic Canada (50%) are much more likely than those in other parts of the country to use a sudden gift of $5,000 towards paying off debt. As well, people in those provinces – and Alberta – are more likely than others elsewhere to say they have been cutting back spending in recent months.

More Key Findings:

- Approaching four-in-five (78%) say grocery stores are taking advantage of inflation to make increased profits. Fewer than one-in-ten (7%) believe instead the increased margins are due to good management by grocery chains.

- The one-in-five (22%) Canadians who say they are never really stressed about money are in the minority. Three-quarters (76%) say the opposite.

- One-quarter (27%) of Canadians say they have trimmed back donations and charitable giving as they have adjusted their budget recently.

- More than half (56%) of Canadians say they can’t keep up with the cost of living, while two-in-five (39%) feel they are keeping pace.

About ARI

The Angus Reid Institute (ARI) was founded in October 2014 by pollster and sociologist, Dr. Angus Reid. ARI is a national, not-for-profit, non-partisan public opinion research foundation established to advance education by commissioning, conducting and disseminating to the public accessible and impartial statistical data, research and policy analysis on economics, political science, philanthropy, public administration, domestic and international affairs and other socio-economic issues of importance to Canada and its world.

INDEX

Part One: Cross-country financial temperature check

-

Three-quarters stress about money, two-in-five worry about their debt

-

Half could not manage unexpected expense of more than $1,000

-

One-in-three worry of job loss

Part Two: The toll of inflation

-

Three-in-five say they are cutting discretionary spending, two-in-five driving less

-

Those in Alberta, Saskatchewan, Maritimes more likely to report cutting back

Part Three: Canadians believe there’s more to rising grocery bills than inflation

-

Four-in-five say grocery stores are taking advantage of inflation to boost profits

Part One: Cross-country financial temperature check

This month’s Statistics Canada’s inflation release brought a slight reprieve, as the pace of inflation slowed. The consumer price index was up 7.6 per cent year over year in July, and prices rose just 0.1 per cent over the preceding month. Relief at the pumps – as the price of gas declined – played a significant role in a lower inflation number. Still, food prices are up 10 per cent since last year, the fastest pace since August 1981, and the price of rent rose faster than the month before.

Even if inflation continues to slow, economists and business leaders expect at least another interest rate hike from the Bank of Canada of between 50 and 100 basis points in September. That would put further pressure on indebted Canadian households as the cost of borrowing increases across the country.

Three-quarters stress about money, two-in-five worry about their debt

To take their financial temperature, Canadians were asked how they would use a surprise, no-strings-attached bonus of $5,000. Half of Canadians would address immediate (10%) or long-term financial obligations (38%). The other half would look to save the money (43%) or make a big-ticket purchase (9%).

Those in Saskatchewan and Atlantic Canada are more likely than others across the country to use the $5,000 to alleviate the financial pressure of debt. One-in-ten (13%) in the Maritimes and Ontario say they would use it to pay day-to-day expenses:

Canadians with lower household income levels are more likely to say that any cash infusion would go to essentials. Indeed, one-quarter (23%) among those with the lowest levels of income say they would pay for day-to-day expenses. For those with income levels higher than $150,000, half say they would put this money into savings or investments:

The cost of borrowing has increased significantly this year as the Bank of Canada tackles inflation. The BoC’s policy interest rate has risen from 0.25 per cent in January to 2.5 per cent last month. And the hikes are expected to continue for the foreseeable future.

Meanwhile, two-in-five (39%) Canadians worry that they have too much debt; three-in-five (58%) are less concerned. Mid-career Canadians (35- to 54-years-old) are more likely than other age groups to fret over their debt load – half (52%) say they have too much debt (see detailed tables). Notably, according to Statistics Canada, this age group holds 57 per cent of the debt in Canada, despite representing one-third of the adult population.

Those in Saskatchewan (57%) are most likely to believe they are holding too much debt as interest rates increase, double the proportion of Quebecers (28%) who say the same:

All in all, three-quarters (76%) of Canadians say they stress about money. Women are more likely than men to say this, including more than four-in-five women under the age of 55:

Half could not manage unexpected expense of more than $1,000

As inflation pressures Canadian budgets, half of the country say they could not manage an unexpected expense of more than $1,000, including one-in-ten (13%) who say any surprise expense would be too much.

Canadians in lower income households are much more likely to say their budget is already too stretched to accommodate any unexpected expenses. One-third (32%) in households earning less than $25,000 annually and 16 per cent in those earning less than $50,000 say there’s no room in their budgets for unplanned expenditures.

Older Canadians report being better positioned to endure an unforeseen expense. Consider that three-in-five of those older than 54 say they could manage an extra $1,000 this month, compared to two-in-five among their younger peers. Those in the 35-to-54 age group are least likely to be able to comfortably afford extra expenses (see detailed tables).

One-in-three worry of job loss

Canadian unemployment levels continue to hover around record lows, but this does not necessarily mean that everyone in the workforce is comfortable. Turmoil in the tech sector has many companies laying off portions of their staff, while on the other end of the spectrum, shortages in health care have the industry and the government plotting how best to staff up.

One-in-three (36%) Canadian households are evidently dealing with uncertainty when it comes to job stability. This dips to 29 per cent in Quebec and rises closer to two-in-five in Alberta, Saskatchewan, and Ontario:

Part Two: The toll of inflation

Three-in-five say they are cutting discretionary spending, two-in-five driving less

Most Canadians say they have had to make adjustments to their budget in recent months as inflation increases the price of essentials. Three-in-five (57%) say they have decreased discretionary spending, while two-in-five (41%) are driving less. Both those figures have increased since the Angus Reid Institute last asked Canadians this question in February. Then three-quarters (74%) of Canadians say they had made spending cuts. Now fully four-in-five say the same:

Those in Alberta, Saskatchewan, Maritimes more likely to report cutting back

Nearly all (92%) in Saskatchewan report cutting back on spending in recent months, a mark 12 points above the national average. They are joined by more than four-in-five in Alberta (86%) and Atlantic Canada (85%). Saskatchewanians are the most likely to report driving less (57%), adjusting travel plans (43%) and cutting back on discretionary spending in general (70%):

Women are more likely than men to say their household has made budget adjustments to rein in spending. Approaching nine-in-ten (88%) 18- to 34-year-old women have made some sort of spending cut, as have 86 per cent of women 35- to 54-years-old. Notably, young men, too, have adjusted their spending habits at a higher rate than their older peers:

As most Canadians trim their budgets to make room for ballooning costs for daily necessities, many across the country feel left behind. A majority (56%) say they can’t keep up with the cost of living, while two-in-five (39%) feel they are keeping pace. The sentiment of falling behind climbing prices is significantly more common in Saskatchewan (71%) than elsewhere in the country:

Part Three: Canadians believe there’s more to rising grocery bills than inflation

Four-in-five say grocery stores are taking advantage of inflation to boost profits

Grocery prices have been a cause of heated debate in recent months. All three of Canada’s largest grocery conglomerates – Loblaws, Metro, and Empire – have enjoyed increased profit margins as inflation has ticked upward. One investigation found that the rate of price increases at those grocers outpaced the rate of inflation, suggesting that these companies may be profiting in excess with inflation as a guise for price hikes. Representatives for these companies have denied profiting off of inflation, instead pointing to efficiency gains and increased sales of high-margin profits, rather than price gouging, as explaining their continued growth. Some economists believe recent financial results, which have shown dipping or flat profit margins at the country’s major grocery companies, have weakened the case for so-called “greed-flation”.

For their part, Canadians are aligned across age, income, education, and other demographics, in believing that companies are taking advantage of inflation to increase their prices further than necessary. Four-in-five across nearly all of these groups say this the case, while one-in-12 believe grocers that these gains are from savvy business maneuvering:

Survey Methodology:

The Angus Reid Institute conducted an online survey from Aug. 8-10, 2022 among a representative randomized sample of 2,279 Canadian adults who are members of Angus Reid Forum. For comparison purposes only, a probability sample of this size would carry a margin of error of +/- 2.0 percentage points, 19 times out of 20. Discrepancies in or between totals are due to rounding. The survey was self-commissioned and paid for by ARI.

For detailed results by age, gender, region, education, and other demographics, click here.

To read the full report, including detailed tables and methodology, click here.

To read the questionnaire in English and French, click here.

Image – PiggyBank/Unsplash

MEDIA CONTACT:

Shachi Kurl, President: 604.908.1693 shachi.kurl@angusreid.org @shachikurl

Dave Korzinski, Research Director: 250.899.0821 dave.korzinski@angusreid.org

Jon Roe, Research Associate: jon.roe@angusreid.org