Varcoe: Staggering $17B drop in value of downtown towers fuels search for solutions

Since 2015, about 160 office properties located south of the Bow River have seen their collective assessments shrink by more than two-thirds

Article content

A new year has delivered another nasty wallop to the value of Calgary’s downtown office towers.

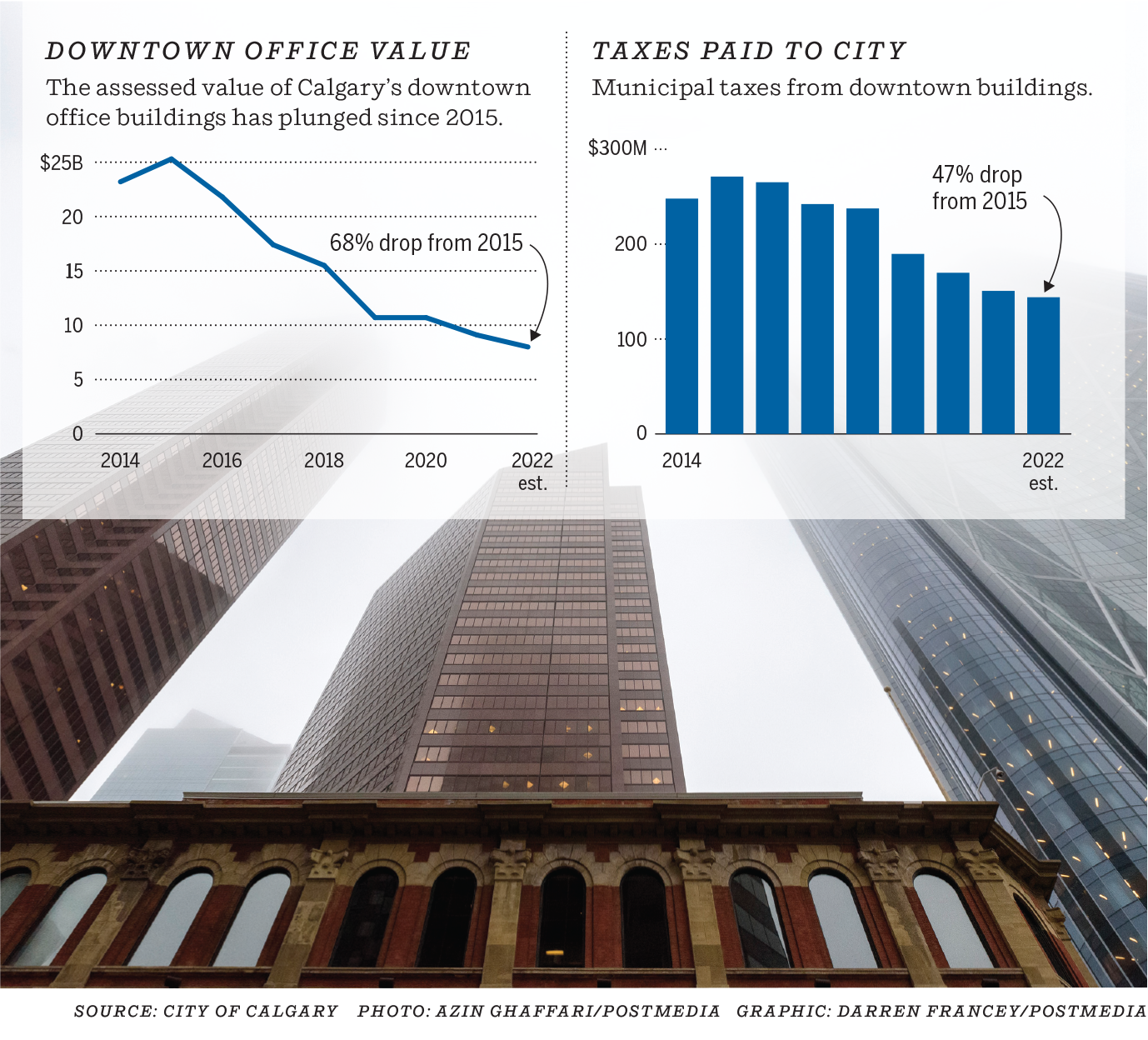

New data from the city’s annual reassessment process this week shows office buildings in the core lost another $1.1 billion of their combined value for the new tax year.

Since 2015, about 160 office properties located south of the Bow River have seen their collective assessments shrink by more than two-thirds to $8 billion.

It amounts to a whopping $17.3-billion decline over seven rocky years.

“This is something we anticipated, not only as a council but as Calgarians. We knew that this was going to be tough,” Mayor Jyoti Gondek said in an interview Friday.

“We will slowly rise up out of this, but it is going to be slow.”

Across the entire city, office properties shed 10 per cent of their value, while residential assessments went up by six per cent.

For downtown office structures, the new figures continue a streak that began after oil prices collapsed last decade. With the exception of a brief respite three years ago, downtown office values have steadily eroded.

“Some of the economic woes have continued. With some of the mergers and acquisitions — namely Husky and Cenovus merged — they are now consolidating office space,” said city assessor Eddie Lee.

“And the pandemic hit.”

The shrinking values are linked to escalating vacancy rates and lower rents that owners can charge.

Office vacancy levels in the core began last year at 30 per cent and exited the fourth quarter around 34 per cent, according to commercial real estate firm CBRE Ltd.

“A 10 per cent (assessment) drop in one year is huge,” said Greg Kwong, CBRE’s regional managing director for Alberta.

“But if you add it with other years that it’s dropped, it’s quite stark.”

Consolidation in the energy sector, the main tenant in the downtown, continued in the past year. Since 2020, the total number of head offices in the city has dropped to 102 from 117.

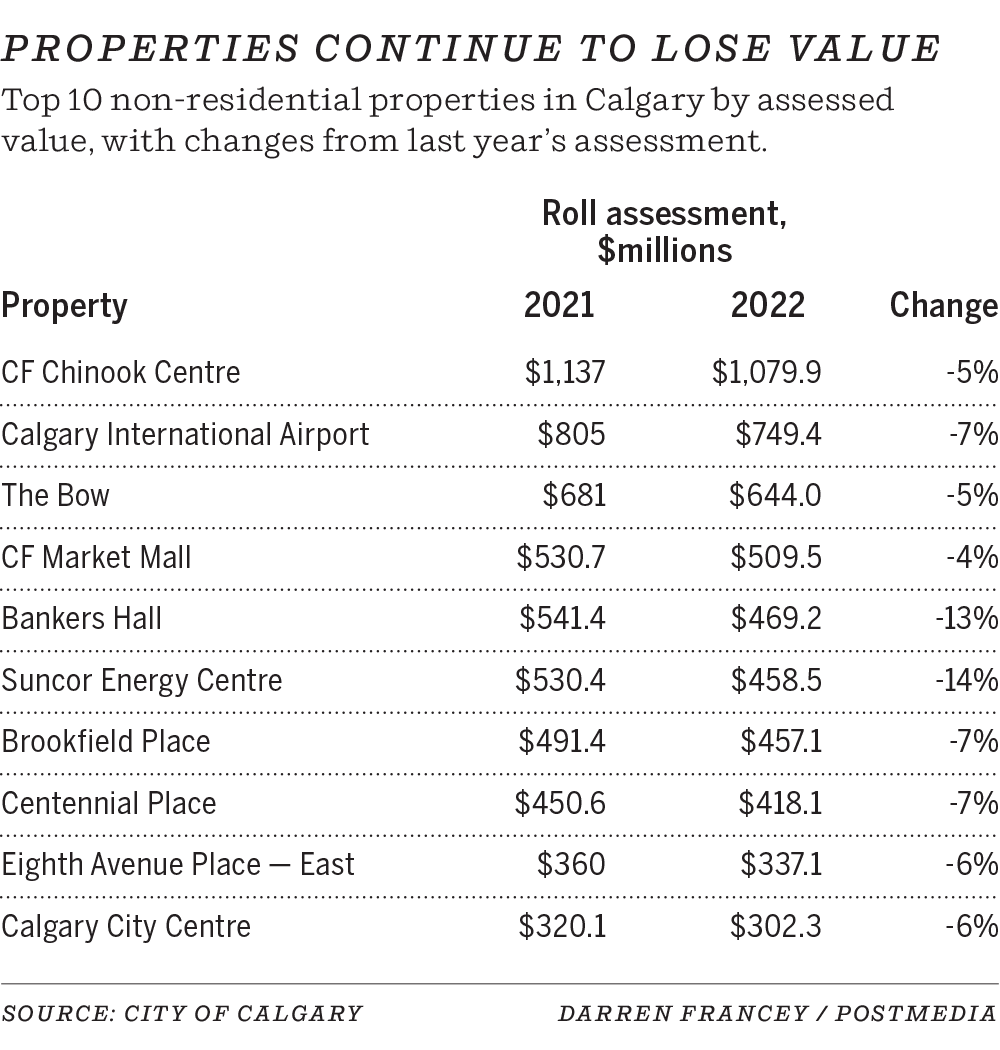

A glance at the latest assessment data about the city’s marquee office skyscrapers shines a light on the issue.

At Bankers Hall, the property’s assessed value fell 13 per cent from 2021 levels, according to city data. It’s now valued at $469 million.

The city’s tallest building, the 56-storey Brookfield Place, fell by seven per cent to $457 million.

And the Bow, the distinctive crescent-shaped building that is Calgary’s second-tallest structure, continued on a similar trajectory.

Back in 2015, the Bow’s property assessment topped $1.4 billion. For the 2022 tax year, it’s valued at $644 million (down five per cent from last year’s level) with assessments based on market valuations as of July 1.

(Last August, H&R REIT announced it had agreed to sell the Bow building to Oak Street Real Estate Capital, pegging the transaction’s total value at $1.2 billion. With the sale occurring after July, it wasn’t used in the latest reassessment.)

Lee noted another major sale of several office towers in November came in close to the city’s assessed value.

The decline in the downtown office market, which was overbuilt during the last oil-price surge, points to the ongoing challenge facing Calgary’s core.

Five office buildings in the area are completely empty. The vacancy rate in the downtown’s west end, home to many older office structures, sat at 50 per cent in the third quarter, according to Avison Young.

“The problem is we’re not overbuilt; we are under-demolished,” said Trent Edwards, Canadian president for Brookfield Properties Development and co-chair of Calgary Economic Development’s real estate sector advisory committee.

“That’s why the big focus for us working right now with the city is to try and remove the vacant office space.”

There is no simple way to solve this conundrum, but a concerted effort to pull more people into the downtown and convert some buildings to apartments and condos must continue.

The decline directly impacts the tax bills for the rest of Calgarians, who must pick up the gap and shouldered higher property taxes as part of the revenue-neutral assessment process.

On the positive side of the ledger, city documents note rental rates have stabilized in some areas and more tech companies are renting offices downtown.

“We are starting to see the tide turn,” said Susan Thompson, a research manager at Avison Young in Calgary.

“It genuinely looks like we have found the turning point in Calgary’s office market because we are starting to see less space being given back to the market.”

City hall adopted a downtown rejuvenation strategy last year that could also make a difference over the long haul.

One of its key planks is the new Downtown Calgary Development Incentive Program, providing a grant of $75 per square foot to owners willing to convert office buildings into residential units.

Armed with $45 million of city money, the program attracted almost a dozen qualified projects, leading to an additional $55 million contribution from council.

The larger $100-million incentive program should convert about 1.3 million square feet of office space, while adding about 1,400 housing units to the downtown — from studios to larger three-bedroom apartments.

Once approved, these projects are expected to attract more than $300 million in private sector investment, beginning later this year.

“I wouldn’t be panicking,” said Ward 1 Coun. Sonya Sharp. “If we see nothing in six to eight months, then we should start reconsidering what are we doing with our downtown?”

Patience will be required.

The mayor noted council put additional money into the office-conversion initiative last November and senior levels of government should also help, which would accelerate efforts to revitalize the core.

The UCP government set up a working group last spring to examine the future of Calgary’s downtown. The report is expected in the coming weeks.

The province is talking with post-secondary institutions “as to whether or not they’re interested in bringing resources into the downtown,” said Jobs and Economy Minister Doug Schweitzer.

Provincial involvement in affordable housing in the city will be examined. Schweitzer also wants to talk with the mayor about the city’s event centre project, which was recently derailed.

“I don’t think it will be one silver bullet that makes our downtown a vibrant, long-term asset,” he said.

It’s been seven long years to get to this difficult point with Calgary’s downtown, although some potential solutions are on the table.

However, the hole just got a little bit deeper to climb out of.

Chris Varcoe is a Calgary Herald columnist.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.