Abstract

As research on venture accelerators develops, different models have emerged in the literature. These focus on the goals of the accelerator, which range from creating profit for managers and building support for business platforms to promoting regional economic development, as well as on its organizational form based on its for-profit or non-profit status. This article examines a novel model, the networked venture builder model, which offers an alternative perspective on the acceleration process. Using the example of the Alacrity Global Ecosystem (AGE), this article explores how the venture builder model includes characteristics of multiple accelerator types, which has helped it both rapidly grow new ventures and achieve substantial economic development goals. Synergies between the different aspects of the AGE’s organizational design help it support multiple missions. Drawing on interviews with key stakeholders and entrepreneurs within the AGE, this article describes the history of the AGE and its present form, providing new insights into a novel, but increasingly common, accelerator design and laying the basis for further research on its emerging organizational form.

Similar content being viewed by others

Introduction

Venture accelerators are one of the defining features of modern technology entrepreneurship. Since the formation of organizations such as Y Combinator and Techstars in 2005, accelerators have helped shift entrepreneurial support away from focusing on firm survival (incubators) or reducing the risks of innovation (science parks) toward enabling rapid scaling through seed investment, intensive mentorship, and rapid product development. The global growth of accelerators, along with successes emerging out of the most prominent accelerators in the United States, has led to a vibrant research interest in the topic. This research has explored different facets of accelerators, such as their organizational characteristics (Hochberg, 2016), the ways in which they support entrepreneurial growth (Cohen et al., 2018), and their role as intermediaries in entrepreneurial ecosystems (Nichols-Nixon et al., 2021). The expanded interest in the diverse nature of accelerators has occurred in the context of a growing awareness of the marked disparity between leading innovation centres and those places left behind — “the places that don’t matter” (Rodríguez-Pose, 2018). Awareness of the disparity in economic outcomes has also prompted greater attention to the contribution that accelerators can make in supporting and stimulating the growth of local and regional economies (Assudani et al., 2017).

As part of this expanded interest in accelerators, researchers have developed various accelerator typologies, distinguishing for-profit accelerators from publicly financed accelerators focused on economic development and corporate accelerators focused on nurturing business platforms (Ester, 2018; Pauwels et al., 2016). But as accelerators spread and evolve, we observe new models that blend elements of existing typologies. These new models, or organizational forms, challenge simplified views of three accelerator types and instead point to hybrid structures that combine features of all these models and exhibit new characteristics and structures. As part of that development, we see the emergence of a new model of accelerator: the accelerator network with branches in multiple locations under a single brand. The network aspect of this model creates opportunities for internal learning processes between individual branches of the network. These accelerator networks grow through partnerships between private accelerators, large corporations, and regional or national governments. Such partnerships blur the distinction between types of accelerators, merging private organizational goals for profit with public economic development goals aimed at reducing regional disparities.

This article analyses one such example of that emerging model: the Alacrity Global Ecosystem (AGE). The AGE builds on elements of a traditional incubator by combining aspects of private accelerators, corporate accelerators, and public accelerators. Termed the networked venture builder model, this diverges from traditional accelerator design in several ways and illustrates the growing diversity of potential accelerator designs. It simultaneously exhibits features of a franchise model in which a central business model is replicated in multiple locations with a contextually sensitive, place-based approach. Drawing on a review of corporate documents from Alacrity and related organizations, press reports, and interviews with accelerator managers and clients, this article details the features of the venture builder model and discusses how it fits within the wider framework of venture acceleration. The article is an exploratory study that seeks to highlight the unique character of the AGE and consider how it relates to other existing models of new venture support. By exploring the organizational structure, motivations, and impacts of the AGE, this article contributes to the accelerator literature, providing a new typology of accelerator organization and setting out an agenda for further study of these new aspects of the acceleration process.

In the next section, the existing typologies of accelerators are reviewed, followed by a discussion of how accelerators have been used by various parties to achieve private and public goals. Section 3 introduces the history of the AGE and the research methods used to analyse it. Section 4 discusses the unique features of Alacrity’s venture builder model and compares key aspects of the AGE with parallel research conducted on more conventional incubators and accelerators. The article concludes, in Sect. 5, by discussing the need for a more nuanced understanding of accelerators and sets out an agenda for examining their role within their broader business and entrepreneurial ecosystems.

Accelerators in context

Defining acceleration

An accelerator (also known as a business accelerator or a seed accelerator) is defined as a fixed-term, cohort-based program for supporting new ventures, which includes aspects such as mentoring and educational components and culminates in a pitch event or demo day (Cohen, 2013). Accelerators differ from other types of location-based entrepreneurship support due to their focus on learning (Cohen et al., 2018). Accelerators bring together several entrepreneurial teams at similar stages, allowing entrepreneurs to learn from each other about how to overcome the common challenges that all new ventures face (Bergek & Norrman, 2008; Hasan & Koning, 2019). These peers are “treasure troves” for helping entrepreneurs develop new ideas and better understand what is required to scale their firms (McDonald & Eisenhardt, 2019, p. 3). Learning does not come from peers alone: accelerator managers curate networks of mentors and advisors to help entrepreneurs with specialized tasks such as product development, sales, and marketing. These intermediaries provide skills and use their own networks to connect entrepreneurs with potential customers and other stakeholders (Dutt et al., 2016).

Acceleration is a multi-stage process starting with the selection of firms to support and the curation of different advisors, mentors, and intermediaries (Amezcua et al., 2019). The program itself is a time-limited support phase in which firms often co-locate to work and receive intensive training and individualized mentorship (Drori & Wright, 2018). Entrepreneurs selected in a competitive process use seed capital from the accelerator to prototype their product and make initial sales, which allows them to enter the market and adjust their product or business model accordingly (Garrido et al., 2020). This period may last anywhere from a few weeks to more than a year. At the end of the program, participants pitch their firms to investors at a demo day to attract attention as they transition away from the accelerator. However, the accelerator still has a stake in its alumni’s success, often providing post-graduation support and inviting alumni back as mentors and investors (Pauwels et al., 2016).

The purpose of this design is to catalyse the rapid evolution and growth of innovative entrepreneurial ventures. The resources, training, and other support provided by accelerators are designed to enable rapid business model development, product innovation, and market research. This helps the firm undertake strategic pivots on the path to achieving product-market fit (Shankar & Shepherd, 2019). The support infrastructure makes it easier for firms to re-engineer their product plans and intended markets in response to what they have learned through initial sales and customer contact. The focus on rapid learning and growth distinguishes accelerators from prior models of entrepreneurship support, such as science parks and incubators, which both looked to de-risk innovative entrepreneurship through the provision of subsidized office space, innovation infrastructure, and corporate services.

Models of acceleration

Accelerator models refer to archetypes in the design, structure, and organization of the accelerator to achieve the goals of the organization’s stakeholders. The design and function of an accelerator reflects its goals, ranging from private profit to broader regional economic development. Pauwels et al. (2016) develop a three-part typology of accelerators. First, deal flow makers are accelerators focused on creating investible firms that can quickly grow, achieve market traction, and exit through an Initial Public Offering (IPO) or merger. Deal flow makers profit through equity ownership in the client firms, which they receive in return for the firms being able to participate in the acceleration process and receiving a seed investment and intensive mentorship from well-connected industry insiders. The original accelerators, TechStars and Y Combinator, first developed this model, and it has been implemented globally by for-profit accelerators.

The second type of accelerator model is ecosystem builders. These are corporate accelerators whose goal is to support firms with a broader business ecosystem or technology platform, such as Microsoft’s Accelerator, which supports firms that build on Microsoft’s product infrastructure. Business ecosystems are value-creation networks in which one firm develops a common platform that connects users and producers, with the focal firm profiting from these connections (Gawer, 2014). However, a common problem in platform business models is that users will not join a platform with no producers providing services they need, and producers will not join a platform without users (Adner, 2016). Ecosystem builder accelerators are one way to overcome this barrier by supporting new ventures that join the ecosystem and create new forms of value in it (Thomas et al., 2018). Such accelerators are often sponsored by large companies looking to support their own platforms. They may either take equity ownership in the firms supported through these accelerators or simply provide grants and services in the hope that client firms will produce value for them through their platform activities.

The third model introduced by Pauwels et al. (2016) is the welfare stimulator. These accelerators, often funded and managed by public economic development organizations or universities, have a mission to contribute to overall regional economic development by stimulating scale-up activities and building a stronger regional entrepreneurial ecosystem.Footnote 1 This welfare development occurs in two ways. First, the firms supported by the accelerators create new jobs and increase the tax base when they grow, contributing to regional economic development in the short and medium term. Second, accelerators can take on important roles as intermediaries and community builders in nascent entrepreneurial ecosystems, helping to create the networks of entrepreneurial supporters that can support high levels of firm growth (Clayton et al., 2018). In regions without previous examples of successful entrepreneurship, accelerators can become key nodes around which broader entrepreneurial communities develop (Goswami et al., 2017). The public backing of these welfare stimulator accelerators allows them to engage in entrepreneurial ecosystem development activities that generate little direct revenue but can play a significant role in building a sustainable foundation for future entrepreneurial growth. This is particularly true in underdeveloped regions where such roles are not being fulfilled by the private sector.

Pauwels’s typology is based on organizational design rather than governance, which limits our understanding of how accelerators work and their connections with larger local and global economic and social systems. A second way of classifying accelerator models is based on their management. The goals of management, be it private profit or public benefit, will affect every aspect of accelerator design and, subsequently, firm outcomes. Private accelerators are started and run by professional investors, who take equity stakes in client firms and profit when they undergo an exit via merger or IPO. Their goal is to leverage their own business skills and capital to find and fund high-potential firms to enable these firms to scale and exit quickly. The founders of such accelerators are often serial entrepreneurs or venture capitalists themselves, and they can use their insights into the entrepreneurship process to select and mentor high-potential new ventures. This was the management model of the original accelerators, TechStars and Y Combinator, and it has been replicated globally. Such management models encourage a broad portfolio of firms in a variety of different sectors to balance the risks associated with the low chance of success of any individual firm (Cohen et al., 2019).

Public accelerators are sponsored and funded by public bodies — often local or national governments or economic development organizations. The profit goal is balanced against other economic development goals, such as supporting locally founded firms, addressing local economic specialization (such as an accelerator focused on maritime technology in a formally strong fishing economy), or maximizing the social value created by entrepreneurs. These goals affect different aspects of accelerator design, such as the criteria of the selection activities, the main accelerator process, and how much equity the accelerator retains, if any. In many cases, public accelerators are one arm of a more multi-faceted economic development strategy, such as how the Start-Up Chile accelerator directly connects with that country’s immigration policy (Gonzalez-Uribe & Leatherbee, 2017).

University accelerators, established and managed by universities as part of their research commercialization and educational missions, are similar to public accelerators. University accelerators are physically based in a university and are designed to support faculty, students, and alumni who want to gain entrepreneurial experience. These types of accelerators are often linked with university research activities, either directly supporting research-based spinouts or encouraging collaborations between entrepreneurs and researchers. Often their physical design and location are chosen to encourage interaction between entrepreneurs and researchers through close interaction (Busch & Barkema, 2020). However, while such accelerators have a public mission or goal related to education or research, they may also have an explicit profit-oriented goal intended to contribute back to their university’s general funds. Either goal will influence the organization and structure of the accelerator, such as leading it to focus on particular market or technology sectors or support under-represented entrepreneurial teams.

Finally, corporate accelerators are established and financed by large companies as part of a broader corporate entrepreneurship strategy (Urbaniec and Żur, 2021). These may be linked with specific company-owned business platforms to support an ecosystem development strategy, or they may invest in specific sectors related to the company’s primary mission (Kohler, 2016). Corporate accelerators often mix employee-started ventures with external ventures both to achieve strategic fit with their ongoing operations and to benefit from open innovation strategies (Shankar & Shepherd, 2019). These accelerators draw on the expertise and networks of senior executives to connect with both internal development teams and external customer groups to spur the growth and market penetration of the new ventures. The goals of such accelerators vary, from business ecosystem development to long-term profit to brand building within different communities.

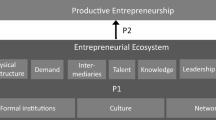

What started a decade ago as a single model of investor-owned private accelerators has now evolved into a wider view of different ecosystem models and backers (see Table 1). As shown in Fig. 1, this has led to a complex array of organizational forms and missions; but even these more complex typologies lack nuance. There is little room, for example, for a private accelerator whose mission includes regional welfare stimulation or an accelerator with public support aimed at contributing to business ecosystems. The empirical reality is more nuanced than simple concordances between missions and funders. As a result, new models of accelerator design, which go beyond these existing categories, are emerging.

The alacrity global ecosystem

Overview

The Alacrity Global Ecosystem (AGE) is a useful case to examine the emergence and structure of more hybrid accelerator models. The AGE is not a formal organization (although the individual accelerators are registered as companies or non-profits). Instead, it is a network of businesses designed to source entrepreneurial opportunities, identify nascent entrepreneurs, and provide mentorship and investment to help the businesses exploit these opportunities. Its activities are carried out not only to provide deal flow to investors but also to encourage wider economic development strategies in partnership with regional and national governments to build the business ecosystems of partner firms.

The AGE has three features of note that exemplify a hybrid acceleration model. The first is the AGE’s venture builder model, in which the accelerator identifies high-potential leaders, creates founding teams, and trains the teams in entrepreneurial skills, while seeding them with potential business opportunities around which they can build their firms. Second, the AGE exhibits attributes of all three accelerator models in that it creates deal flow for investors, works to generate value within existing business ecosystems, and incorporates explicit regional economic development goals into its model. In this respect, it is particularly sensitive to the unique characteristics and needs of the regional innovation systems in which it is embedded. Third, the AGE represents a new networked accelerator form in which additional accelerators are established in international locations. These new outposts seek to take advantage of the common acceleration model that the AGE is built on, while simultaneously adapting to local contextual differences.

The next section briefly examines the different components of the AGE. The distinctive properties of the model are discussed in more detail in Sect. 4.

Methods

To study the AGE, the research team conducted 20 interviews with accelerator managers and clients in three locations (Ottawa and Victoria, Canada, and Newport, Wales) and with more senior management in the parent organization. These three locations were chosen based on their status as the original three members of the AGE. Each of the original locations deployed a slightly different variation on the model, adapted to the unique circumstances of the regional innovation system and the organization partners with which the local accelerator was aligned. Experience with these three initial locations formed the basis for the AGE practice of allowing a certain degree of variation in the institutional design of each local member of the network. We follow the approach, suggested in the relevant literature, of using a case study to “confirm, challenge or extend” existing theories in the field (Yin, 1989, p. 47). This is necessarily an exploratory approach, with the goal of understanding the activities of the accelerator network, its design, and the underlying organizational logic.

The interviews were conducted by the authors at each location using a comparable interview guide. Interviews were conducted with the key executives operating the accelerator in each location, as well as with a cohort of firms participating in the accelerator at the time when the interviews were conducted. The interviews were semi-structured, designed to gain a better understanding of the operations in the AGE and people’s experiences within them. Interviews with managers focused on the history of the accelerator, why the particular location was chosen for the accelerator, the factors that accounted for the initial design features of the accelerator in that location, reasons for any subsequent changes to the initial design, how participants were recruited to the accelerating, and the current basis for organizing their entrepreneurial support activities. Entrepreneur interviews included sections that queried how the individuals were recruited to the accelerator, their reasons for choosing to participate in the accelerator, how their entrepreneurial teams were formed, their experience as members of the accelerator, and the nature of the support they received.

Interviews were coded through a thematic process in which the authors identified the factors associated with the history and activities of Alacrity. Accelerator managers shed light on the underlying logic of how individual accelerators operate and their relationships with key stakeholders. Interviews with entrepreneurs provided a ground-level perspective on how these support structures supported firm innovation and growth. Given the exploratory nature of the study, this was a purposefully open-ended process designed to elicit multiple viewpoints with the goal of understanding the underlying logic of how the various entities within the AGE operate.

We employed within-method and between-method triangulation to increase the robustness of our analysis (Uwe, 2004). Interviews with the executives of the local accelerators were triangulated with the responses provided by members of the entrepreneurial teams, as well as across the different experiences at the three locations. By comparing interviews with accelerator managers and entrepreneurs, we were able to appraise areas of agreement and disagreement. Interviews were also triangulated with public information sources such as newspaper articles (26 articles in regional and national newspapers), information from organizations’ websites, blog posts, and corporate documents. These research methods were used as additional sources of confirmation for the perspective on accelerator activities provided by the interviews. The aim was to produce a thick description of the AGE to identify how it compares with the broader models of venture acceleration (Pratt, 2008). Thick description is particularly useful when studying a critical case that can reveal new patterns and show shortcomings in existing theories (Patton, 2015).

Unique features of the alacrity global ecosystem

The AGE is comprised of three different and distinctive organizational forms. The first is Wesley Clover, an investment holding company founded by the Welsh Canadian serial entrepreneur Terry Matthews in 1972. Matthews co-founded telecommunications manufacturer Mitel, which was sold to British Telecom in 1985. Subsequently, he founded Newbridge Networks, a voice and data equipment manufacturing firm acquired by the French telecom firm Alcatel in 2001. Beginning in the early 1990s, Wesley Clover began to develop an “affiliate” model to link entrepreneurs who could fill potential niches in the Newbridge product mix that were promising but which were not attractive enough for Newbridge to pursue directly. The development of this model relied on accumulated insights by the management of Wesley Clover into market trends and customer needs to identify opportunities for prospective entrepreneurs, who were then supported with the upfront investment capital and customer contacts necessary for them to grow. These new ventures, termed Newbridge Affiliates, were often seeded with former colleagues and associates of Matthews as senior managers (Interview 13). Wesley Clover claims to have invested in more than 100 companies, relying on this model with a 94 per cent success rate in its venture investment portfolio.Footnote 2

By 2010, the Newbridge Affiliates model had evolved into a venture creation model in which Wesley Clover would identify problems facing customers of its existing firms or external partner companies, which represented viable businesses but were too risky for the larger organizations to pursue. These could be identified by sales teams working with clients or by members of the Wesley Clover senior executive team examining the market offerings. A manager described the process as “different from a traditional incubator, in that you can pair a commercial problem with a team of young, smart, clever guys that are given entrepreneurial expertise in order to shape them to run and manage their own technology company” (Interview 8). Once an opportunity was identified, Wesley Clover’s management would select the founding team to develop the opportunities. Such teams were frequently composed of recent university graduates, often with software development or engineering degrees, who would receive business and entrepreneurial training. These founders did not have a prior relationship before they were introduced by Wesley Clover executives, as one founder in Canada recounted: “And so [executive] introduced me to my business partners…. and so we got slammed together in a 10 by 10 [foot] room for about a year” (Interview 4).

While Wesley Clover was based in Ottawa, Ontario, it invested globally, with an initial focus on Wales and Victoria, British Columbia. Through Wesley Clover, these new firms would receive seed investment and would be connected to existing market channels in larger firms, such as Newbridge, to find customers. The accumulated social and symbolic capital of Wesley Clover management and associates provided the new firms with legitimacy and connected them with stakeholders such as mentors, suppliers, intermediaries, and customers (Huggins et al., 2018).

The second organizational form within the AGE is Alacrity accelerators. The concept for the Alacrity accelerators was co-designed by two key Wesley Clover executives, one based in Victoria, British Columbia, and the other in Wales. First launched in 2009 in Victoria, the Alacrity program began as incubators but has gradually incorporated more elements of acceleration. The Alacrity accelerators combined deal flow and welfare stimulator models with a unique relationship with a specially designed master’s degree program in the Faculty of Engineering at the University of Victoria (although this program was subsequently discontinued). Both accelerators were partially funded with local support from regional development agencies. The Alacrity Accelerator model brings together traditional accelerator/incubator approaches, in which existing teams are selected for participation in an intensive training and mentorship program while receiving subsidized office space and support.2 It culminates in investment pitches, as well as a venture-building approach in which young nascent entrepreneurs are selected and given a business opportunity sourced through the managers’ business networks. Subsequently, new Alacrity accelerators have opened in Newport, Wales; Ottawa, Canada; Istanbul, Turkey; Lille, France; and Huixquilucan, Mexico, with future branches in development for Chile, Dubai, and India.3 Interviewees suggested that less than half of Alacrity firms receive investment capital directly from Wesley Clover, with the start-up firms free to approach other investors (Interview 14).

A key component of the Alacrity model has been to attract additional support from regional and national governments with the aim of using the accelerators to spur the broader economic development of their respective regions.Footnote 3 In this way, the AGE has been linked to the specific dynamics of the regional innovation systems in which they are located. The first two accelerators — in Victoria and Newport — were in semi-peripheral regions with strong local talent pools and a goal of building robust modern technology economies. Bringing the accumulated experience of Wesley Clover to bear on the challenge of technology development in these regions made the model appealing to regional economic development agencies (Huggins et al., 2018). News reports and interviews with multiple Alacrity executives suggest that the organization looks to promote regional economic development by (1) creating or supporting high-growth ventures that will create jobs and attract new capital to the region, (2) attracting other global investors to the region through their demo days and other investor events to showcase the local economy to a global audience, (3) improving the entrepreneurial capacity of the region through entrepreneurial training and upskilling, (4) building stronger local networks within the entrepreneurial community through outreach efforts and events at their facilities, (5) reducing the risk to private sector investors by pooling private and public investment. As part of this mission, Alacrity accelerators build linkages with local universities, not only to source technical expertise for existing businesses they support, but also to identify young graduates with high potential who may be good targets for their venture builder model. The goal of these efforts is to build both a network of young entrepreneurs forming high-growth ventures and a larger cohort of STEM-trained students who have a solid foundation in practical business activity. A Welsh Alacrity manager explained to us that “now employers are saying, ‘We’d be prepared to move to Newport in south Wales if you can get the numbers [of skilled graduates] to the level that you want.’ We intend to get to double the output [of students] in the next few years. And if we can get up to sort of a couple of thousand, that is a huge impact for employers in the area” (Interview 6). High-potential students are identified through partnerships with local universities, as well as through the personal networks of accelerator managers. An interviewee based in the Victoria accelerator provided an example of how young founders were identified to work on a new venture:

I was just at an event last week up at UVic, talking to the professors about a data science and a service company that we’re trying to talk about firing up. You know, the last company that went through the entrepreneurship program would be X, who we brought in last March. We matched a team of three entrepreneurs from Vancouver who were already starting a company, and then we matched them with three engineers from UVic that wanted to do the entrepreneurship program, and we married them together and created X last year. (Interview 14)

The third organizational form in the AGE is L-SPARK, a more traditional accelerator based near the headFootnote 4quarters of Wesley Clover in Kanata, a suburb of Ottawa that is known for its high-tech industry. L-SPARK focuses on highly scalable software-as-a-service (SaaS) firms, which have begun to cluster in Kanata and Ottawa’s downtown since 2010. Unlike firms created through the venture builder model, L-SPARK selects existing firms based on their business plans and market trajectory and the characteristics of their founding teams for a six-month acceleration program in which the firms’ participation costs, including mentors and space, are covered. If the company raises money during the six-month program or the following twelve-month period, L-SPARK receives a 3 per cent equity stake in the company. Like the other Alacrity accelerators, L-SPARK is a joint public/private initiative, supported by both the Canadian government through its regional development agency and delivered through the local economic development agency, Invest Ottawa. L-SPARK’s economic development mission is similar to that of the other Alacrity sites in Victoria and Newport: to strengthen the local ecosystem by supporting high-growth entrepreneurship and bringing together disconnected actors in the business and entrepreneurial community, while providing investment opportunities for Wesley Clover.

The AGE has evolved into a complex network of different organizations and stakeholders (see Fig. 2). The private capital from Wesley Clover is leveraged with public funds from regional and national economic development agencies or philanthropic groups to build acceleration facilities, hire managers, and provide stipends and payments to client firms. But, just as importantly, Wesley Clover provides network capital that identifies opportunities for entrepreneurship and attracts private investment capital (Huggins et al., 2018). Partnerships with local universities are used to establish training partnerships and identify high-potential graduates who can be formed into venture teams. Thus, partner universities act as both creators of human capital (through their educational role) and funnels for skilled people (in their talent identification roles). This network capital helps client firms access resources they would not otherwise be able to access and connect with potential customers, suppliers, and advisors who can help them enter new markets.

Key properties of the alacrity global ecosystem

The networked venture builder model

Alacrity’s networked venture builder model has evolved from a variety of different initiatives launched by Wesley Clover since its formation in the 1970s. Rather than supporting existing entrepreneurial firms who pursue a problem identified by the founders, as would be the case for a normal accelerator, the Alacrity model focuses on finding appropriate, high-potential founding teams who are then seeded with an opportunity fed to them through Wesley Clover’s business networks. These efforts are funded through both Wesley Clover’s investment activities and local governments looking to use these activities to catalyse entrepreneurship-led economic development. The venture-building approach is designed to address two issues facing entrepreneurial growth, both of which are particularly important in semi-peripheral regional economies.

First, the approach helps compensate for a lack of business opportunities in the local market. The quality of an opportunity is one of the most important determinants of firm success, and much of the entrepreneurship process is related to testing the opportunity and the venture’s solution (Kerr et al., 2014). While the ontological status of entrepreneurial opportunities can be debated (Goss & Sadler-Smith, 2017; Sarason et al., 2006), the experience, characteristics, skills, and networks of an entrepreneur are key to identifying new opportunities in the marketplace (Alvarez & Busenitz, 2001). Entrepreneurs normally identify opportunities through their network connections to identify problems facing potential customers and then use internal heuristics developed from their own experiences to judge whether this represents a suitable market given the perceived risks. Entrepreneurs’ prior work and life experiences can afford them insights into niche opportunities (Ucbasaran et al., 2001), particularly in business-to-business sectors, where problems may be invisible to people without significant experience in an industry. Regions with economies based on declining industries and little history of entrepreneurship are less likely to have entrepreneurs whose networks and experience allow them to identify opportunities in faster-growing, often technology-based, sectors. This makes it difficult for them to use entrepreneurship as a tool to reorient their economies to more prosperous sectors.

The networked venture builder model addresses that issue by importing actors with high-quality networks and the skills to leverage these networks to identify opportunities in global business ecosystems. Wesley Clover has supported firms that provide ancillary technology for an existing product line in one of its related companies and, more recently, has oriented a company toward solving a sales problem facing one of its resort properties located in Newport, Wales. The opportunity arose when the resort’s sales team approached the Alacrity Foundation when they saw a commercial opportunity in the marketplace for a technology that could address their problem (Interview 8). Through these networks, Alacrity managers identify problems that are big enough to represent real opportunities but are too risky or niche for major companies to take on themselves. Such global opportunities are not necessarily tied to local markets or networks, and thus compensate for the lack of local network-based insights into growing markets.

Second, the model addresses the lack of entrepreneurial skills that often hampers the economic development of peripheral or declining regions (Xu and Dobson, 2019). Alacrity accelerators build formal and informal partnerships with local universities to identify high-potential students and graduates. These are not necessarily students with prior experience in entrepreneurship. Documents from Alacrity suggest that they are primarily looking for students with technical skills who demonstrate the aptitude and personality to be able to develop the required business skills through formal and informal educational processes.Footnote 5 Over time, these educational efforts have become increasingly formalized, with the Welsh branch now offering an accredited business education program involving classroom learning delivered by Alacrity staff and selected private sector mentors who offer their time as guest presenters. Similar, though still unaccredited, educational programs are present at other branches. Commonly, the young founding teams are paired with a senior executive who has previously worked with Wesley Clover, either as an official board member or a more informal mentor. The senior executive provides more business skills to what is often a very homogenous and technical-heavy founding team, helping to address skill gaps that could slow growth (Fuel et al., 2022).

This is an experiential learning process, which aims to combine classroom learning with venture development. Entrepreneurial teams in the Alacrity accelerators benefit from the structured learning environment, as well as from the more informal learning opportunities that emerge from interacting with mentors and other participants. Most of the entrepreneurial education for the students housed in the accelerators arises from a rich exposure to mentors, including the directors of the accelerators themselves. Part of the model’s success derives from the ability of the heads of the accelerators to recruit a wide variety of professionals with a diverse range of business experience to serve as mentors for the students in the program. The business mentors are expected to cover a wide range of aspects in the business start-up process. This leads to better learning outcomes by allowing participants to recontextualize the experiences of others so they can apply these experiences to their own situations (Harrison & Leitch, 2010; Zozimo et al., 2017). Even if Alacrity-based firms fail, the educational experience received by the entrepreneurs increases their chances of success in future endeavours due to the skills and networks they developed through the accelerator. The venture builder model takes the basic logic of acceleration — rapid business model innovation spurred by intensive peer learning and mentorship, powered by investment and other forms of support — and combines it with the network capital of Wesley Clover and Alacrity to identify opportunities, form partnerships, and build an educational curriculum for participants. This model focuses on building teams of high-potential founders who can be oriented toward an opportunity in a partner business ecosystem.

Interviewees identified the process of team creation and team building as critical to the success of their ventures within the AGE. Several suggested that care was taken to ensure that the teams had the right mix of skills needed for the success of their business model and the appropriate interpersonal dimension. An Alacrity manager gave an example from one of their recent companies:

You know, the last company that went through the entrepreneurship program would be [X], who we brought in last March. We matched a team of three entrepreneurs ... who were already starting a company, ... with three engineers from [the University of Victoria] that wanted to do the entrepreneurship program …. The best part, though, was the three ... business side people in [X] ... had excellent backgrounds.... one of them is a [Chartered Public] Accountant, so the finance side was totally covered. (Interview 14)

Many of the interviewees identified the most valuable aspect of the AGE as helping the teams find an initial commercial partner within Wesley Clover’s business ecosystem. These connections, when combined with mentorship from accelerator managers, allowed new ventures to obtain their first sales and engage with customers to develop their product/market fit. The advantages of this approach were best stated by one firm in the Victoria accelerator, which was not based on a pre-identified opportunity. The founder explained that although they were not able to align their product with the Wesley Clover network offerings, they were able to use the shared services and brand equity of Wesley Clover to access the business connections and investment capital needed to grow the firm (Interview 9).

Several companies that had received funds from Alacrity’s seed investment fund were positive in their assessment of this aspect of the program. They maintained that investments from Wesley Clover and the Alacrity accelerators helped avoid an expensive and time-consuming search for initial ‘seed-stage’ venture capital. Having access to the initial investment funds as part of their exit process from the accelerator gave them a leg up in launching their company and expanding beyond their initial commercial partner to grow their sales pipeline. Beyond the direct investment, the networks of Wesley Clover were useful for identifying follow-on investors outside the accelerator. One entrepreneur who was running short on funds described how he was introduced to his latest investor “through an event that … a Wesley Clover affiliate put on” (Interview 3).

Combining impact models

One of the most novel aspects of the AGE’s organizational design is the blending of multiple accelerator models within the network. As shown in Fig. 3, most of the accelerator models have sought to generate deal flow by creating high-growth firms that produce above-average profits for investors through buyouts or IPOs. Success in deal flow generation comes from selecting competent teams and supporting them with equity investments and subsidized office space, as well as using network capital to connect them with mentors, advisors, and customers. However, Wesley Clover and several Alacrity accelerators (such as the Alacrity Foundation in Wales and the L-SPARK accelerator in Ottawa) have also adopted the ecosystem builder model. For Wesley Clover and Alacrity in Wales, this has involved building on the business ecosystems of firms related to Wesley Clover’s telecommunications or hospitality ventures; for Ottawa’s L-SPARK, this has focused on technology ecosystems such as QNX’s automotive software platform. The venture builder approach practised at Wesley Clover and Alacrity is inherently a corporate accelerator approach based around ecosystem building through the pre-identification of opportunities in a value chain or business ecosystem.

The rapid growth of the AGE since 2009 is largely due to its adoption of the welfare stimulator model with a focus on spurring regional economic development in peripheral economies. This includes peripheral economies in developed economies such as Canada (Victoria, British Columbia) and the United Kingdom (Newport, Wales) as well as emerging economies such as Mexico and Turkey. Indeed, news reports quote the CEO of the Wales-based Alacrity accelerator as saying, “Alacrity was established with the simple mission of assisting in the renewal of South Wales’ economic base.” Grants from economic development agencies support the activities of Alacrity and L-SPARK accelerators in multiple locations, ranging from Victoria to Istanbul, through both operational grants and co-investment funds with Wesley Clover and local investors. Welfare stimulation is predicated on the belief that supporting high-growth potential firms not only creates new jobs through their rapid growth but also, through their success (and even failure), contributes to building a stronger local entrepreneurial ecosystem that will support future entrepreneurship inside and outside of the accelerator.

The AGE was an emergent design that developed out of immediate needs and opportunities facing individual managers in each location, rather than the product of a grand strategy. Adopting multiple models of acceleration created an internal learning process in which the activities of one approach (for example, deal flow generation) contribute to the future activities of other approaches (such as welfare stimulation; see Fig. 4). Deal flow models prioritize rapidly building investible ventures that have a clear road to a profitable exit. This is primarily aimed at enriching investors and entrepreneurs. But the act of creating such firms necessarily contributes to the regional entrepreneurial ecosystem (Stam, 2015). The actions of the accelerator help establish or renew networks of investors, mentors, and advisors; the growth of the firm attracts new investment capital and builds up entrepreneurial experience that can recycle into the ecosystem over time (Spigel & Vinodrai, 2020). Successful deal generation also helps allied business ecosystem-building activities. Success in a business ecosystem builds the accelerator’s legitimacy in the community within this space, making it easier for subsequent firms in the accelerator to gain access to business ecosystem stakeholders and customers (Srinivasan & Venkatraman, 2018).

Business ecosystem-building models help semi-peripheral regions compensate for their lack of local market opportunities, facilitating entrepreneurial training and development without relying on the local economy to provide a foundation for business ideas. This contributes to regional economic welfare, creating a pathway to building high-growth entrepreneurial ventures, which strengthens the local entrepreneurial ecosystem (Auerswald & Dani, 2017). As the entrepreneurial ecosystem grows, it creates better conditions for future entrepreneurial endeavours. This should improve the performance of ecosystem builder accelerators by ensuring that firms have access to important resources, such as a deeper labour pool, an expanded array of potential mentors and investors, and a better entrepreneurial culture.

Finally, regional welfare-stimulation goals go hand in hand with improved deal flow capacity for accelerators through contributing to a healthier entrepreneurial ecosystem. One of the principal ways that the welfare accelerator model does this is by building up intermediary networks in the region (Goswami et al., 2017). A welfare stimulation accelerator plays an active role in fostering new networks in a region, bringing together formally disconnected members of the business community to create a population of available mentors and other supporters to help highly ambitious entrepreneurs. These types of activities stimulate other goals, such as deal flow generation and business ecosystem building, by ensuring that entrepreneurs have a supportive local community to draw on as they grow (Audretsch & Belitski, 2016).

Global acceleration network

The final aspect of the AGE that diverges from our current understanding of accelerators is the global network aspect of the Alacrity accelerators. This phenomenon is not unique to Alacrity. Other accelerators, such as Tech Stars (founded in Boulder, Colorado, and now with branches in Boston, Seattle, New York City, Paris, and Amsterdam) and the Creative Destruction Lab (founded in Toronto, now with branches in Atlanta, Calgary, Halifax, Montreal, Vancouver, Oxford, Paris, and Wisconsin), have also expanded from a single site to multiple locations. The AGE is one of the most internationalized examples of an accelerator network, with nine branches open or in development in eight countries: Canada, the United Kingdom, France, Dubai in the United Arab Emirates, India, Mexico, Chile, and Turkey. Each of the Alacrity accelerators adopts a similar venture builder approach in that it draws on the network capital of the AGE and local partners to source business opportunities and match founder teams with specialized training and mentorship opportunities. Some of the accelerators, such as Alacrity Victoria and L-Spark in Ottawa, also have more traditional accelerator activities, which involve existing firms joining to accelerate their growth. Some of the accelerators are subsidized through public regional-development funds and adopt specific welfare-stimulation goals, while others focus solely on deal flow and ecosystem stimulation activities.

But this expansion does not represent identical branches. Each branch attempts to be sensitive to the context of its regional innovation system, reinterpreting the venture builder model to fit the resources and capabilities of its location. For example, before the Alacrity Foundation opened in Wales, Matthews was quoted as saying, “We have a version of [Alacrity] in Canada and we have honed it down for the UK, and in particular for Wales.”5 This contextualization is achieved through local partnerships with investors and large companies looking to tap into the deal flow and business ecosystem stimulation aspects of the Alacrity model, as well as post-secondary institutions and regional development authorities. Alacrity can recruit local partners due to the social and symbolic capital of Wesley Clover’s management team. Its track record has helped it forge new partnerships with local governments to locate in regions that are looking for economic development catalysts.

There is currently limited research on the implications of global accelerator networks. While the growing work on entrepreneurial context (Baker & Welter, 2018; Welter, 2011) makes it clear that the entrepreneurship process is influenced by local economic, social, institutional, and cultural structures, it is unclear how such factors affect the acceleration process. To be sure, accelerators in developing economies, such as Latin America and Africa, adjust their operations to deal with resource constraints such as a lack of skilled workers, market opportunities, and follow-on investment capital (Roberts & Lall, 2019). But, outside of the national economic level, little is known about how accelerators adapt to their context. This study of the evolving model of the Alacrity Global Ecosystem provides a useful lens to expand our understanding of that phenomenon by illustrating how the network’s basic strategy, philosophy, and approach has adapted to its various locations.

Discussion and conclusion

As the research literature on accelerators has grown, several typologies have developed to categorize these organizations based on their goals, strategies, and stakeholders. The Pauwels et al. (2016) model represents one of the most popular typologies of accelerator design, distinguishing between deal flow, ecosystem builder, and welfare stimulator models. Other typologies look at stakeholders such as private investors, corporations, universities, or the state. While this is a useful breakdown, the example of the Alacrity Global Ecosystem suggests that accelerator design is evolving beyond such categorizations. The AGE represents a new networked venture builder model that not only curates existing ventures for growth support but also focuses on identifying high-quality opportunities in existing business ecosystems linked to stakeholders and then finds teams of promising nascent entrepreneurs to pursue these opportunities with backing, training, and investment from the accelerator. In carrying out these venture-building activities, the AGE adopts multiple acceleration models. This contributes to a self-reinforcing system in which the activities aimed at one model support the other goals. Activities designed, for example, to improve deal flow by creating high-quality innovation firms contribute to welfare-stimulation goals and improve the accelerator’s ability to contribute to value creation in existing business ecosystems. Such mutually beneficial designs suggest that a more nuanced typology of accelerators is needed. The AGE also illustrates a new feature of some accelerators: the internationalization of acceleration through the development of a global network. Such growth strategies show that accelerator managers see themselves as having a scalable business model; at the same time, however, Alacrity’s experience shows the need for careful modifications of this underlying design to thrive in different local contexts.

The example of the AGE suggests that a research agenda is needed to gain a better understanding of this emerging model. First, researchers could examine networked accelerators to understand how organizational practices are spread between facilities and if this makes new establishments more effective than if they operated independently. Comparing the performance of networked versus independent accelerators in similar locations would help establish the impact of organizational design on the ability of these organizations to contribute to entrepreneurial growth. Second, the venture builder model, in which larger companies identify opportunities and then recruit and support entrepreneurial ventures to fulfil them, is an interesting approach to entrepreneurship that is understudied in the literature. It invites new perspectives on corporate entrepreneurship, such as examining how the venture builder model influences the culture and routines of a new organization, as well as comparisons of its efficacy verses other models of corporate entrepreneurship and new venture creation. Finally, this article shows the importance of examining and describing new and emergent venture builder models to understand their role in how companies, investors, and regions look to harness the power of entrepreneurship for prosperity and economic development.

Notes

Business ecosystems (supported by the business builder model) and entrepreneurial ecosystems (supported by the welfare stimulator model) are distinct concepts. The former refers to value creation networks that link different competing and cooperating firms, while the later refers to the localized actors and factors that support high-growth entrepreneurship.

The History of the Alacrity Entrepreneurship Course: https://alacrityfoundation.co.uk/history/, August 2021.

Alacrity Ecosystem: https://alacrity.co/ecosystem/, September 2022 plus confidential interview.

“Four business start-up from Sir Terry Mattshews’ Newport high-tech bootcamp” https://www.southwalesargus.co.uk/news/11679214.four-business-start-ups-from-sir-terry-matthews-newport-high-tech-bootcamp, December 2014.

“Alacrity quick off the mark with £150,000 HQ refurbishment.” Wales Online: https://www.walesonline.co.uk/business/business-news/alacrity-quick-mark-150000-hq-2034599, March 2012.

References

Adner, R. (2016). Ecosystem as structure. Journal of Management, 43(1), 39–58. https://doi.org/10.1177/0149206316678451.

Alvarez, S. A., & Busenitz, L. W. (2001). The entrepreneurship of resource-based theory. Journal of Management, 27(6), 755–775. https://doi.org/10.1016/S0149-2063(01)00122-2.

Amezcua, A., Ratinho, T., Plummer, L. A., & Jayamohan, P. (2019). Organizational sponsorship and the economics of place: how regional urbanization and localization shape incubator outcomes. Journal of Business Venturing, 105967. https://doi.org/10.1016/j.jbusvent.2019.105967.

Audretsch, D. B., & Belitski, M. (2016). Entrepreneurial ecosystems in cities: establishing the framework conditions. The Journal of Technology Transfer, 42(5), 1030–1051.

Auerswald, P. E., & Dani, L. (2017). The adaptive life cycle of entrepreneurial ecosystems: the biotechnology cluster. Small Business Economics, 49(1), 97–117.

Assudani, R., Mroczkowski, T., Fernández, A. M., & Khilji, S. E. (2017). Entrepreneurial support systems: role of the Czech accelerator. IJEIM 21, 530. https://doi.org/10.1504/IJEIM.2017.086955

Baker, T., & Welter, F. (2018). Contextual entrepreneurship: an interdisciplinary perspective. Foundations and Trends® in Entrepreneurship, 14(4), 357–426. https://doi.org/10.1561/0300000078.

Bergek, A., & Norrman, C. (2008). Incubator best practice: a framework. Technovation, 28(1–2), 20–28. https://doi.org/10.1016/j.technovation.2007.07.008.

Busch, C., & Barkema, H. (2020). Planned luck: how incubators can facilitate serendipity for nascent entrepreneurs through fostering Network Embeddedness. Entrepreneurship Theory and Practice.

Clayton, P., Feldman, M., & Lowe, N. (2018). Behind the Scenes: intermediary Organizations that facilitate Science Commercialization through Entrepreneurship. Academy of Management Perspectives, 32(1), 104–124. https://doi.org/10.5465/amp.2016.0133.

Cohen, S. (2013). What do accelerators do? Insights from incubators and angels. Innovations: Technology Governance Globalization, 8(3/4), 19–25.

Cohen, S., Fehder, D. C., Hochberg, Y. V., & Murray, F. (2019). The design of startup accelerators. Research Policy, 1–17. https://doi.org/10.1016/j.respol.2019.04.003.

Cohen, S. L., Bingham, C. B., & Hallen, B. L. (2018). The role of accelerator designs in Mitigating bounded rationality in New Ventures. Administrative Science Quarterly, 15, 000183921878213–000183921878245. https://doi.org/10.1177/0001839218782131.

Drori, I., & Wright, M. (2018). Accelerators: characteristics, trends and the new entrepreneurial ecosystem. Edward Elgar Publishing. https://doi.org/10.4337/9781786434098.00005.

Dutt, N., Hawn, O., Vidal, E., Chatterji, A., McGahan, A., & Mitchell, W. (2016). How open system intermediaries address institutional failures: the case of Business Incubators in Emerging-Market Countries. Academy of Management Journal, 59(3), 818–840. https://doi.org/10.5465/amj.2012.0463.

Ester, P. (2018). Accelerators in Silicon Valley. Amsterdam University Press. https://doi.org/10.1515/9789048538683.

Fuel, P., Pardo-del-Val, M., & Revuelto-Taboada, L. (2022). Does the ideal entrepreneurial team exist? International Entrepreneurship and Management Journal, 18,1263–1289. https://doi.org/10.1007/s11365-020-00739-x

Garrido, T. M., de Lema, D. G. P., & Duréndez, A. (2020). Assessment criteria for seed accelerators in entrepreneurial project selections. International Journal of Entrepreneurship and Innovation Management, 24, 53–63. https://doi.org/10.1504/IJEIM.2020.105276.

Gawer, A. (2014). Bridging differing perspectives on technological platforms: toward an integrative framework. Research Policy, 43(7), 1239–1249.

Gonzalez-Uribe, J., & Leatherbee, M. (2017). The Effects of Business Accelerators on Venture Performance: evidence from Start-Up Chile. The Review of Financial Studies, 31(4), 1566–1603. https://doi.org/10.1093/rfs/hhx103.

Goss, D., & Sadler-Smith, E. (2017). Opportunity creation: entrepreneurial agency, interaction, and affect. Strategic Entrepreneurship Journal, 12(2), 219–236. https://doi.org/10.1002/sej.1273.

Goswami, K., Mitchell, J. R., & Bhagavatula, S. (2017). Accelerator expertise: understanding the intermediary role of Accelerators in the development of the Bangalore Entrepreneurial Ecosystem. Strategic Entrepreneurship Journal. https://doi.org/10.1002/sej.1281.

Harrison, R. T., & Leitch, C. (2010). Voodoo Institution or Entrepreneurial University? Spin-off companies, the Entrepreneurial System and Regional Development in the UK. Regional Studies, 44(9), 1241–1262.

Hasan, S., & Koning, R. (2019). Prior ties and the limits of peer effects on startup team performance. Strategic Management Journal, 40(9), 1394–1416. https://doi.org/10.1002/smj.3032.

Hochberg, Y. V. (2016). Accelerating entrepreneurs and ecosystems: the seed Accelerator Model. Innovation Policy and the Economy, 16(1), 25–51.

Huggins, R., Waite, D., & Munday, M. (2018). New directions in regional innovation policy: a network model for generating entrepreneurship and economic development. Regional Studies, 52(9), 1294–1304. https://doi.org/10.1080/00343404.2018.1453131.

Kerr, W. R., Nanda, R., & Rhodes-Kropf, M. (2014). Entrepreneurship as Experimentation. Journal of Economic Perspectives, 28(3), 25–48. https://doi.org/10.1257/jep.28.3.25.

Kohler, T. (2016). Corporate accelerators: building bridges between corporations and startups. Business Horizons, 59(3), 347–357. https://doi.org/10.1016/j.bushor.2016.01.008.

McDonald, R. M., & Eisenhardt, K. M. (2019). Parallel play: startups, nascent markets, and Effective business-model design. Administrative Science Quarterly, 000183921985234. https://doi.org/10.1177/0001839219852349.

Patton, M. Q. (2015). Qualitative research & evaluation methods: integrating theory and practice (4th ed.). SAGE Publications Inc.

Pauwels, C., Clarysse, B., Wright, M., & Van Hove, J. (2016). Understanding a new generation incubation model: the accelerator. Technovation, 50, 13–24.

Pratt, M. G. (2008). Fitting Oval pegs into round holes: tensions in evaluating and publishing qualitative research in Top-Tier North American Journals. Organizational Research Methods, 11(3), 481–509. https://doi.org/10.1177/1094428107303349.

Roberts, P. W., & Lall, S. (2019). Observing acceleration: Uncovering the effects of accelerators on impact-oriented entrepreneurs

Rodríguez-Pose, A. (2018). The revenge of the places that don’t Matter (and what to do about it). Cambridge Journal of Regions Economy and Society, 11(1), 189–209.

Sarason, Y., Dean, T., & Dillard, J. F. (2006). Entrepreneurship as the nexus of individual and opportunity: a structuration view. Journal of Business Venturing, 21(3), 286–305. https://doi.org/10.1016/j.jbusvent.2005.02.007.

Shankar, R. K., & Shepherd, D. A. (2019). Accelerating strategic fit or venture emergence: different paths adopted by corporate accelerators. Journal of Business Venturing, 34(5), 105886. https://doi.org/10.1016/j.jbusvent.2018.06.004.

Spigel, B., & Vinodrai, T. (2020). Meeting its Waterloo? Recycling in Entrepreneurial Ecosystems after Anchor Firm Collapse. Entrepreneurship & Regional Development.

Srinivasan, A., & Venkatraman, N. (2018). Entrepreneurship in digital platforms: a network-centric view. Strategic Entrepreneurship Journal, 12(1), 54–71. https://doi.org/10.1002/sej.1272.

Stam, E. (2015). Entrepreneurial Ecosystems and Regional Policy: a sympathetic critique. European Planning Studies, 23(9), 1759–1769.

Thomas, L. D. W., Sharapov, D., & Autio, E. (2018). Linking entrepreneurial and innovation ecosystems: the case of AppCampus. Edward Elgar Publishing. https://doi.org/10.4337/9781784710064.00008.

Ucbasaran, D., Westhead, P., & Wright, M. (2001). The focus of Entrepreneurial Research: contextual and process issues. Entrepreneurship Theory and Practice, 25(4), 57–81.

Uwe, F. (2004). Triangulation in qualitative research. In U. Flick, von E. Kardorff, & I. Steinke (Eds.), A companion to qualitative research (pp. 178–182). London, pp. 178–182: SAGE.

Welter, F. (2011). Contextualizing entrepreneurship—conceptual Challenges and Ways Forward. Entrepreneurship Theory and Practice, 35(1), 165–184. https://doi.org/10.1111/j.1540-6520.2010.00427.x.

Yin, R. K. (1989). Case Study Research Design and Methodology. SAGE Publications Inc.

Zozimo, R., Jack, S., & Hamilton, E. (2017). Entrepreneurial learning from observing role models. Entrepreneurship & Regional Development, 29(9–10), 889–911. https://doi.org/10.1080/08985626.2017.1376518.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Spigel, B., Khalid, F. & Wolfe, D. Alacrity: a new model for venture acceleration. Int Entrep Manag J 19, 237–259 (2023). https://doi.org/10.1007/s11365-022-00817-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-022-00817-2