Sector is showing signs of life

MICHAEL HEBERT, WOOD MACKENZIE, CALGARY

Canada's oil sands have always been good at attracting headlines, sometime positive and sometimes negative. Following a multi-year battering by low oil prices and project deferrals, the sector began to show some signs of life as 2016 ended. Long-awaited regulatory approvals for several major pipeline projects means market access will be improved and diversified, while three companies re-sanctioned previously deferred projects (Cenovus' Christina Lake Phase G, Canadian Natural's Kirby North and MEG Energy's Christina Lake Expansion, all thermal brownfield projects).

Operating margins turned positive in the second half of the year and production growth continued through the price downturn, exiting 2016 at nearly 2.5 million b/d of upgraded synthetic crude and bitumen. Operating costs at a handful of the best thermal projects fell below C$8/bbl. Not bad for a resource perceived to be high cost.

While tentative shoots of optimism seemed to return, we expect 2017 capital expenditures will be over 60% lower than 2014 levels and new projects will struggle to make returns in a sub-US$55 price environment. The world is also shifting to lower carbon intensity. New Alberta provincial and Canadian federal climate change legislation is unlikely to fully reverse environmentalists' comparison of the oil sands to "Mordor."

In February, we at Wood Mackenzie put out a report highlighting that oil sands would be a cornerstone of global supply, while also noting the challenges faced. We predicted a wave of domestic consolidation. Little did we know just how right we would be, with two blockbuster deal announcements following in March. Wood Mackenzie's M&A service tracked 127 global transactions totaling US$64 billion YTD in 2017. Of those deals, the two Canadian oil sands-focused transactions between Cenovus/ConocoPhillips and Canadian Natural Resources Ltd. (CNRL)/Shell accounted for US$23 billion, or 36% of the total. Upstream deal spend for Canada will now land well above the five-year high (see Figure 1).

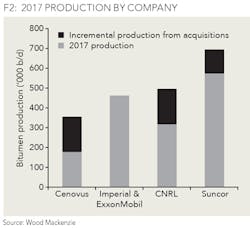

These deals mark a string of high-profile exits from majors and international producers. ConocoPhillips, Shell, Statoil, Murphy, and Marathon have divested the majority or, in some cases, their entire oil sands portfolios during the downturn. This exodus by internationally focused producers is causing stakeholders to question what is next for the leaner, meaner Canadian oil sands sector. Is it an indictment of the sector's future? We counter that the amount paid from the domestic consolidators is a vote of confidence that costs can be kept low while output increases. But it will mean the reins are firmly in the hands of Canadian companies. More than 70% of oil sands production will now be concentrated between four of Canada's largest producers: Suncor, CNRL, Imperial Oil, and Cenovus (see Figure 2).

With such an astounding corporate changeover, it's worth examining the individual deals and their differences before considering what the future holds for Canada's 170-billion-barrel resource.

REVIEW OF EVENTS

Cenovus/ConocoPhillips

On March 29, 2017, Cenovus announced the purchase of ConocoPhillips' 50% stake in the Foster Creek Christina Lake partnership and Deep Basin assets for US$13.3 billion. This is the largest Canadian deal since CNOOC's 2012 acquisition of Nexen. The acquisition makes Cenovus the largest thermal oil sands producer in Canada with full ownership of its operated Foster Creek and Christina Lake projects. We forecast Cenovus' bitumen production to reach 356,000 b/d in 2017.

CNRL/Shell

On March 9, 2017, Shell announced the sale of its 60% interest in the Athabasca Oil Sands Project (AOSP) to CNRL for US$8.5 billion. In a separate, concurrent transaction, Shell and CNRL jointly acquired an equal share of Marathon Oil's 20% interest in AOSP for US$1.25 billion each. AOSP consists of two mining sites with production capacity of 280,000 b/d and the Scotford Upgrader. CNRL now operates the mining operation with a 70% stake while Shell holds 10% and Chevron retains 20%. Shell will continue to operate the Scotford Upgrader and Quest Carbon Capture & Storage with a 10% interest. Shell has an option to trade its remaining 10% mining stake for an additional 10% at the upgrader.

COMMONALITIES BETWEEN DEAL METRICS AND STRATEGIC RATIONALES

It is important to highlight that these transactions were not "fire sales." The deals were conducted at arm's length, with neither party acting under financial duress. The motivations of the sellers are largely unified across the deals and rooted in decarbonization, debt reduction, retrenchment, and capital rationing. Shell, for example, is aggressively reducing the number of geographies and resource themes in which it operates. The company is rapidly closing in on its ambitious US$30 billion divestment program, of which its stake in AOSP was an unfortunate victim.

ConocoPhillips exceeded its divestment target with this deal and has accelerated its buyback program. In short, the price downturn created a situation where international firms were motivated sellers and found receptive buyers in Canada.

All the deals also included some creative deal-making features, such as equity consideration or contingent payments. Equity components for the three deals total a sizeable C$7.6 billion (US$5.8 billion), showing the willingness of sellers to maintain exposure.

Consideration per flowing barrel is a key metric for these deals since the assets feature existing production with low decline rates. The metric is close between the two transactions with Cenovus paying US$44,631/boe compared to US$46,977/boe from CNRL. Our base case valuations for the assets fell short of the consideration paid for both transactions. However, varying the discount rate used from 10% to 8% lifted our values higher than the purchase price for both. This highlights how sensitive the valuations of these long-life projects are to discount rate assumptions and long-term oil price expectations.

MARKET REACTION DIFFERS AS CANADIANS DOUBLE DOWN

While the acquiring companies all increase exposure in their own well-known backyards, there are some nuances to consider. The obvious difference across the deals is the underlying assets. The Cenovus thermal properties have industry-leading low operating costs but without an upgrading facility produce a lower-value product. The Scotford Upgrader enables CNRL's mined AOSP bitumen to be transformed into more valuable synthetic crude oil (SCO).

Cenovus' share price was punished in the market following the announcement of the deal, with its shares plunging 13% the following day. Shareholders were critical of the deal amount and the ancillary acquisition of 2.76 million acres of gas-weighted producing properties in the Deep Basin, Montney, and Horn River. Investors are questioning why Cenovus chose to pursue assets so far removed from its core oil sands operating competencies and are now relying on asset sales to lower debt.

CNRL's experience as an operator at the Horizon mine will allow the company to unlock material upside at AOSP through reductions in operating costs. Wood Mackenzie values the divested Shell assets at US$7.0 billion, US$1.5 billion under the consideration paid. Our current analysis assumes long-term operating costs at AOSP of C$32/bbl of SCO produced: C$20/bbl mining and C$12/bbl upgrading. A 20% reduction to mining and 5% decline in upgrading opex would lift our NPV10 valuation to nearly equal the purchase price. CNRL was able to achieve mining and upgrading operating costs of C$25.20/bbl of SCO at the Horizon project in 2016. Given that track record, large reductions in costs at AOSP are feasible. That feature is absent from the Cenovus transaction where it already operates the projects.

FURTHER CONSOLIDATION

Earlier in the downturn, we saw Suncor build its interests in Syncrude via the C$6.6 billion (US4.6 billion) hostile acquisition of Canadian Oil Sands Corp. and the C$937 million (US$743 million) acquisition of Murphy's 5% stake. Suncor also bought 10% of Total's interest in the Fort Hills mining project for US$258 million. We therefore are characterizing 2015 to 2017 as the Canadian consolidation period in contrast to the Asian acquisition spree of 2009 to 2013.

The consolidation period is clearly not over with several potential exits rumored or speculated. A handful of international companies remain with non-operating interest in the sector. The UK's BP is a 50% partner with Husky at the Sunrise project, US Major Chevron is a 20% partner with CNRL at the Athabasca Oil Sands Project, and France's Total is a 29.2% partner with Suncor at the Fort Hills project and a 50% partner with ConocoPhillips at the Surmont project.

Famed author Mark Twain noted, "History doesn't repeat itself, but it often rhymes," meaning that as we have seen with the oil sands deals of the past, the natural buyers for these projects are the operating partners themselves. However, the market for interested parties is narrow given the concentration of the industry and the highly specialized expertise required to operate oil sands projects.

Potential bidders, such as CNRL and Suncor, are still digesting their newly-acquired assets and likely don't have the immediate appetite for another big deal. However, both are well-capitalized and have been known to make opportunistic acquisitions should the right assets become available. CNRL is exiting a capital-intensive period from the construction of its Horizon project. Following the completion of Phase 3 at Horizon, CNRL is poised to generate over US$3 billion in free cash flow over the next three years if oil remains at US$55/bbl (WTI). Asian firms were once the resource acquirers of the sector but have reined in ambitious investment plans after making expensive acquisitions when oil prices were high.

THE INDUSTRY'S FUTURE

Domestic operators are committed to developing Canada's vast resource potential and reinvesting cashflow from the oil sands back into Canadian projects. This is in stark contrast to the priorities of internationally focused producers that would likely use the predictable and steady cashflow of the oil sands to fund projects abroad. That's one positive that perhaps offsets the loss of a more diverse group of international companies chasing the necessary technological improvements to move the oil sands forward.

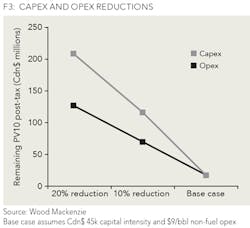

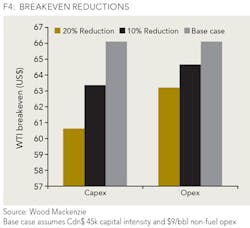

The future of oil sands development will be heavily influenced by technological advances to reduce costs and emissions (these are linked). Greenfield project economics are likely to be challenged unless substantial progress can be made on extraction methodology and operating efficiencies. Wood Mackenzie estimates a 20% reduction in capital intensity for a 35 kb/d steam assisted gravity drainage (SAGD) development would increase the marginal remaining post tax NPV10 to over C$200 million (see Figure 3). That same 20% reduction results in a breakeven price below US$61/bbl WTI (Figure 4) making new greenfield expansions economically feasible.

Adding solvents to steam or removing steam entirely are two technologies being advanced. However, in the near-term, value will likely be realized through project optimization and operating efficiencies for incremental growth. Canadian companies are now doubly reliant on it.

ABOUT THE AUTHOR

Michael Hebert is a research analyst with Wood Mackenzie in Calgary, Canada. He joined the firm in 2014 to provide financial asset valuation and objective commercial analysis on company and play activity throughout Canada. Hebert holds a Master of Science degree in Energy, Trade, & Finance from Cass Business School, University of London, and a Bachelors of Management in Finance from the University of British Columbia. He is working towards obtaining his Chartered Financial Analyst (CFA) designation. Hebert also serves as a member of the board of directors for Young Professionals in Energy, Calgary chapter.