Interested in a rock-bottom rate you see online? You better understand its stipulations.

Interested in a rock-bottom rate you see online? You better understand its stipulations.

Mortgage rates aren’t as straightforward as people think. The competitiveness of your mortgage rate is heavily influenced by whether your mortgage can be default insured.

In some cases—like when you’re buying a home with less than a 20% down payment—you have no choice. You must buy default insurance in most cases.

In other cases, default insurance is either paid for by the lender, is optional or is not available on your mortgage at all.

If you’re like most homebuyers, your eyes glaze over when a mortgage advisor starts talking about insured, insurable and uninsured mortgages. But knowing the difference can better prepare you for your next mortgage or renewal.

Here’s a quick rundown of the three types…

What is an Insured Mortgage?

Insured mortgages generally have the lowest interest rates of all because there is less risk and expense for the lender.

If you default, the lender gets paid by the insurer. If the insurer becomes insolvent, the Government of Canada backstops the insurer.

Because risk is minimized for the lender and because the borrower pays the default insurance premium, the lender’s cost of lending is lower. And hence, it can pass along better rates.

Insured mortgages:

- Require the borrower to pay the insurance premium

- Protect the lender if you default, not you the borrower

- Are mandatory when your down payment is less than 20%

- Generally apply when the mortgage has a loan-to-value (LTV) of 80.01 to 95% (the maximum allowed)

- Technically you can buy default insurance at virtually any LTV. In rare cases, it may make sense to pay the default insurance premium on a low-LTV mortgage in order to get better terms from the lender.

- Are stress-tested at the Bank of Canada’s benchmark rate with a maximum 25-year amortization

- Are not available on non-owner-occupied properties, home purchases of $1 million+ or refinances

- Require the borrower to have good credit (600 minimum credit score), reasonable debt ratios and reasonably verifiable income

- Are available from the Canada Mortgage and Housing Corporation (CMHC), Genworth Canada and Canada Guaranty

- The cost of the insurance can be rolled into the mortgage and paid off over the amortization period, or paid at closing (which almost no one does)

- Note that some provinces (like Ontario) charge tax on default insurance, which must be paid at closing—much to the surprise of many unsuspecting first-time homebuyers

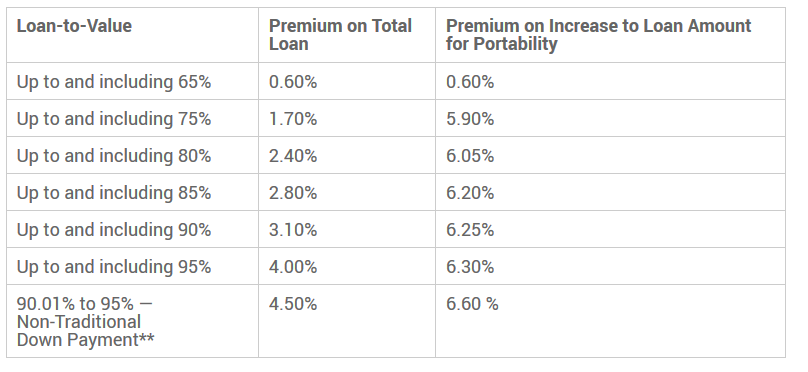

- Here are CMHC’s current mortgage insurance premiums as of April 2019:

Source: CMHC

Spy Tip: When you switch lenders, and assuming you’re not refinancing, make sure the new lender keeps your insurance policy in force. It could help you get a lower rate when you change lenders in the future.

What is a High-ratio Mortgage? A high-ratio mortgage (sometimes referred to as a “transactionally insured” mortgage) is simply an insured mortgage with less than 20% equity.

What is an Insurable Mortgage?

Insurable mortgages are also default insured, with the difference being that the lender pays the insurance premium.

Lenders buy this insurance (a.k.a. “bulk insurance”) in order to lower their risk and/or securitize their mortgages (i.e., sell them to investors). This lowers their funding costs and lets them pass along better rates to consumers—but not as good as the transactionally insured (a.k.a. “high ratio”) rates we talked about above.

Insurable mortgages:

- Are available only on mortgages with 20% equity or more (i.e., a loan-to-value of 80% or less)

- Otherwise have the same lending criteria and characteristics as insured mortgages

- Require no premium payment by the borrower (the lender pays for the insurance)

Spy Tip: Properties of $1 million or more can generally not be default insured. However, if your property was under $1 million when you first got your mortgage, and you haven’t increased the loan amount or amortization since, it may still be insurable under grandfathering rules. That’s true even if the value is over $1 million today.

What is an Uninsurable Mortgage?

Mortgages that cannot be default insured are called uninsurable.

Uninsurable mortgages:

- Apply to any of the following:

- Purchases of $1 million or more

- Refinances (e.g., when replacing your existing loan with a new loan of higher risk, like one where you’re increasing your mortgage size)

- Non-owner-occupied single-unit rental properties

- Amortizations over 25 years

- Require no insurance premiums (obviously)

Does Mortgage Insurance Protect Me?

No. Default insurance is sometimes confused with mortgage life insurance (a.k.a., “creditor life”). The former protects the lender if you default. The latter protects your estate if you die.

Default insurance, as CMHC describes it, “…Lets you get a mortgage for up to 95% of the purchase price of a home. It also ensures you get a reasonable interest rate, even with your smaller down payment.”

It also helps stabilize the housing market. “During economic slumps when down payments may be harder to save, [default insurance] ensures the availability of mortgage funding,” CMHC says.

Higher Down Payments = Higher Rates

Higher Down Payments = Higher Rates

It hardly seems right, but insured mortgage rates—those for purchases with less than a 20% down payment—are typically lower than rates for uninsured mortgages (those with 20% down payments or larger).

People often ask, “Why should someone with less skin in the game be offered better mortgage rates than someone making a bigger down payment?”

In answering this, it’s important to remember that insurance protects the lender and its investors. That means they take on less theoretical risk (regardless of the down payment size). Moreover, thanks to securitization, they don’t need to put up tons of capital or raise hundreds of millions in deposits to originate insured mortgages. Lenders can therefore fund insured mortgages more easily, compared to an uninsured loan.

As a result, pricing on higher-risk uninsured mortgages isn’t as good. Didn’t your mother always tell you life isn’t fair?

As a general rule of thumb, here’s roughly how rates shake out for each type of mortgage:

- Insured mortgages: lowest rates of all

- Insurable mortgages: add the following to the best insured rates you see:

- 5-10 basis points if 65% LTV or less

- 10-15 basis points if 65.01% to 75% LTV

- 15-20 basis points if 75.01% to 80% LTV

- Uninsured mortgages: add 25-35 basis points to the best insured mortgage pricing.

(This pricing is accurate as of April 11, 2019, assuming a 5-year fixed term.)

At the time this is being written, you’d pay only 2.74% on a 5%-down insured mortgage, versus 3.08% if uninsured, other things equal. That, my friends, is the “benefit” of a government guarantee.

log in

log in

Insured mortgages:

Insured mortgages: What is an Uninsurable Mortgage?

What is an Uninsurable Mortgage?

7 Comments

Nice article, though I’d make one correction. 2-4 unit non-owner occupied properties are insurable.

https://www.cmhc-schl.gc.ca/en/finance-and-investing/mortgage-loan-insurance/mortgage-loan-insurance-homeownership-programs/rental-income

Yep, caught that typo just before you wrote in. Thanks Ralph.

When you have to pay the insurance premium, insured 2-4 unit rentals are less economical. Moreover, some lenders’ insured 2-4 unit rates are actually higher than the best uninsured rates at the banks.

is there a way to add CHMC insurance to a non insured mortgage to get a better rate? unlikely worth it for one 5 year term but if you are looking at 4 more 5 year terms those savings would add up.

Hey Eric, Yes, you can pay for default insurance to get a better rate but it typically isn’t worth it because:

a) the premium usually offsets the interest savings

b) the rates at 65% LTV are usually comparable with high-ratio rates

c) most people don’t go through life without refinancing (and refis invalidate your insurance)

Why would anyone in their right mind insure a 2-4 unit rental and pay the 1.45% to 2.90% premium?

http://genworth.ca/en/products/investment-property-program.aspx

You can get much better uninsured rates at major banks with no stupid premium.

Hi Phil,

I looked at the Genworth link, and the mandated DSR formula is better than what some (but not most) banks use for uninsured rental property mortgages.

For example, HSBC does a 70% rental add back, whereas Genworth can do a 100% rental add back.

wow – excellent article. This is a catch 22 for me because I want to put more money down to get a lower overall mortgage amount – but don’t want the high rate. This helped me to understand why having an insured mortgage will help me get the lowest mortgage rate so thank you.